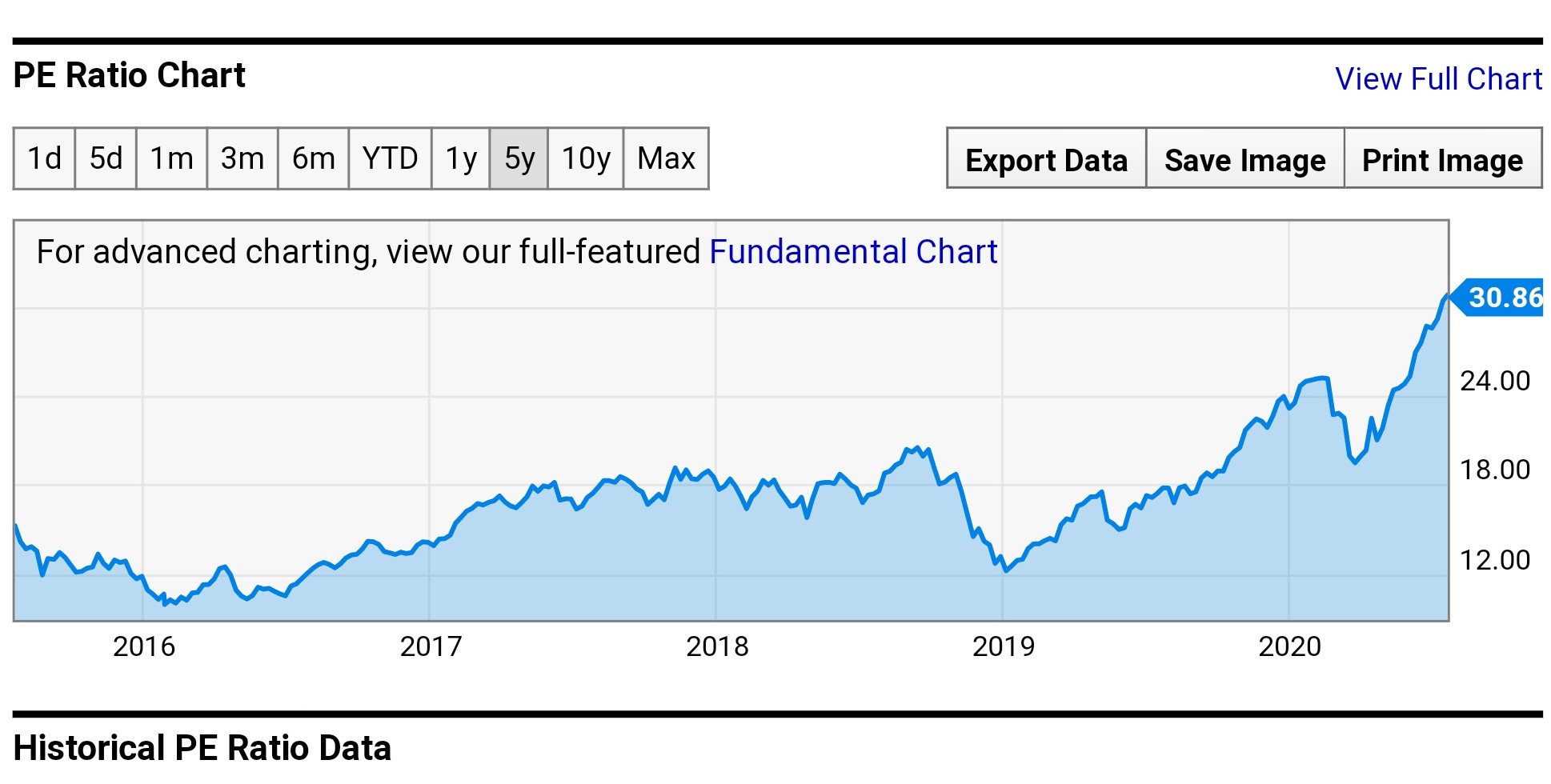

Exactly. Since interest rates went to zero there are no relatively safe investments like bonds, bank deposits etc. All the money forced into the stock market.

Yes, it's ending up there by default. If you look at the historical M2 to stock market ratios then there is scope for markets to go higher....alot higher!

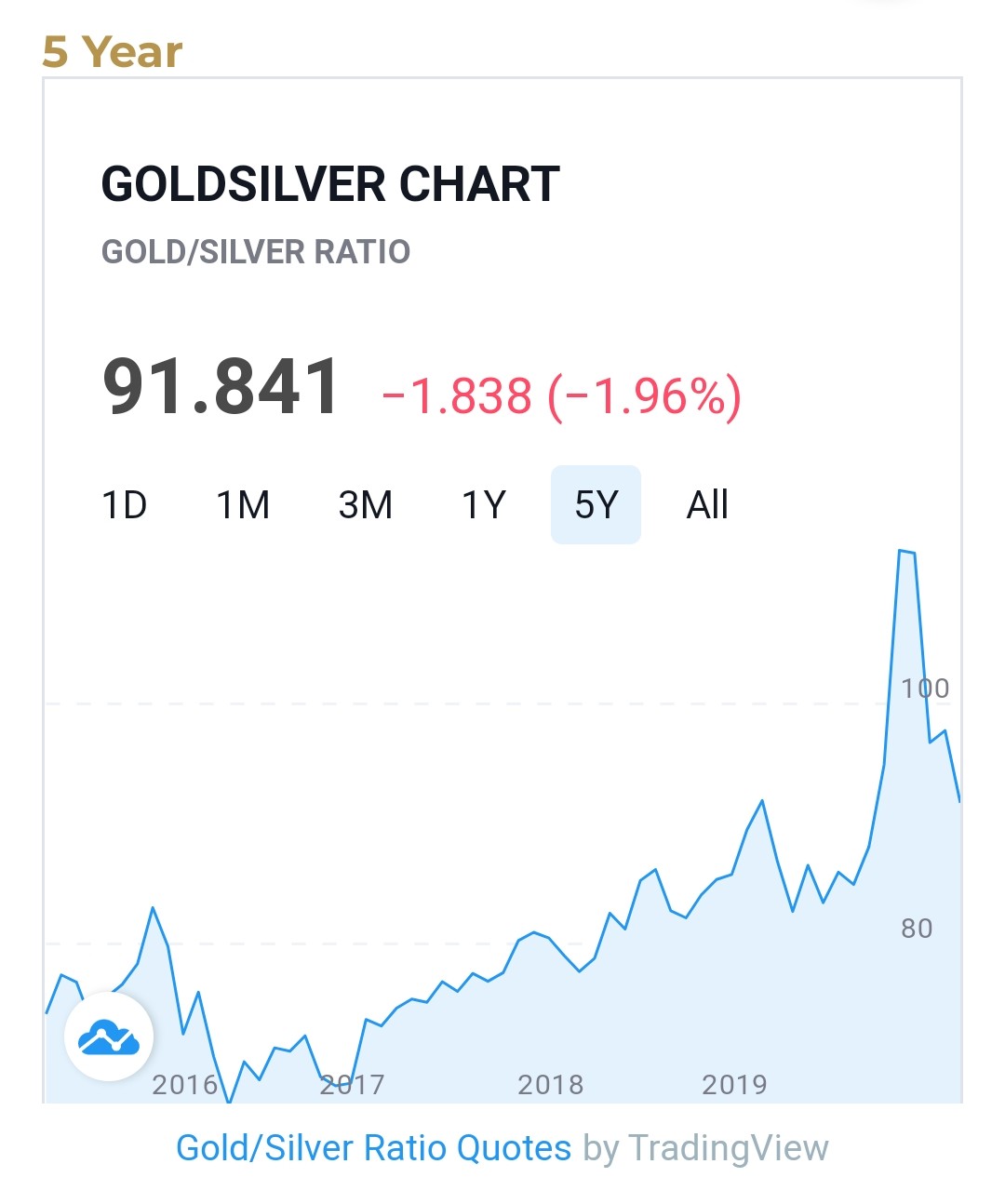

But that money will also end up in property, gold, silver. ATM I'm just seeing the markets bumping along in a narrow range and some investors will get sick of that boring situation...it sure isn't signaling to me that I need to rush in now like I was in March (my mistake was rushing out of some positions too fast Haha)

Although, I suspect a few more bumps in the stock market ride. If there was so much money floating about pre Covid why did the market just do the fastest sell off in history?

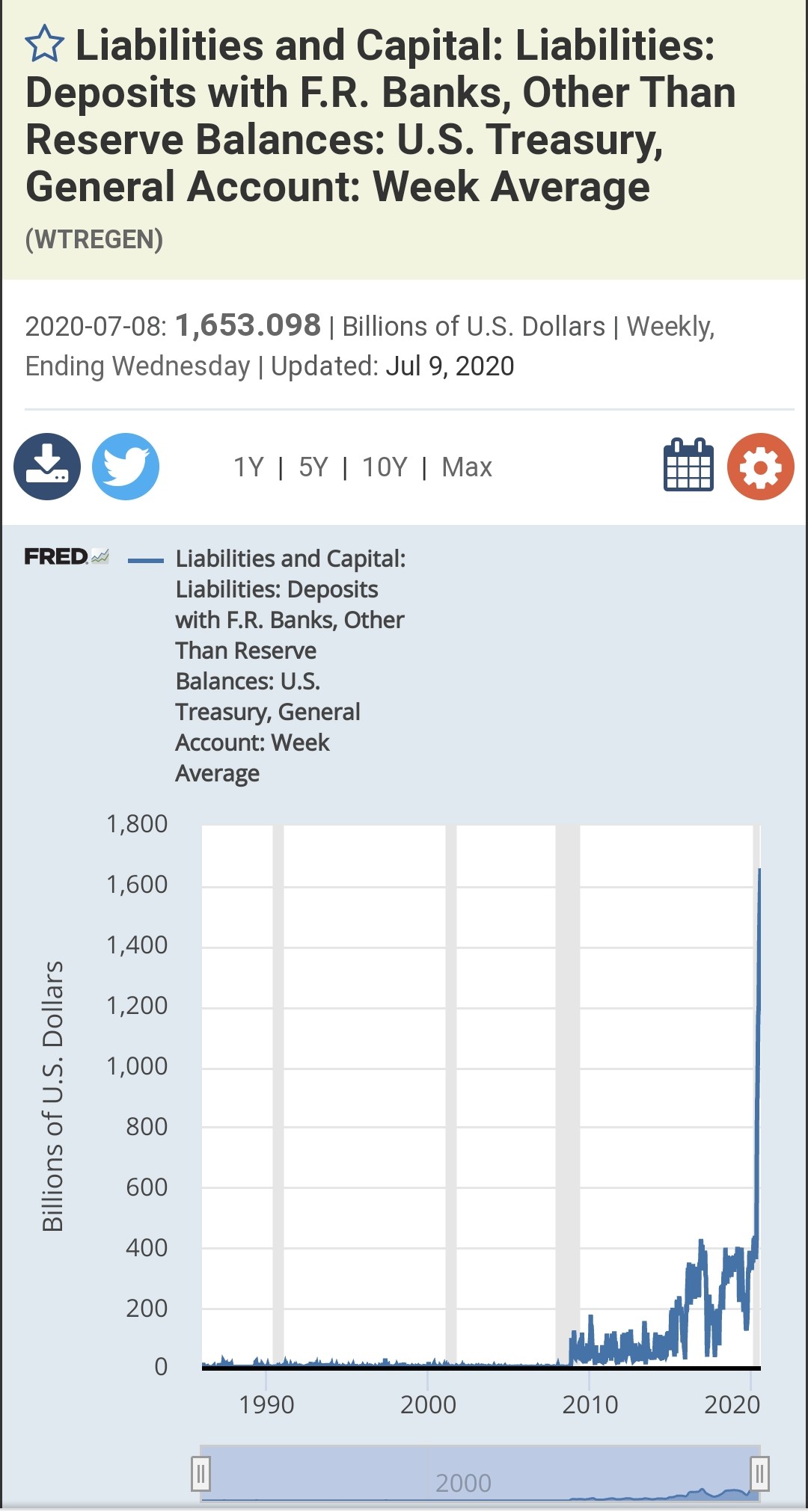

They were doing that until Fed indicated massive stimulus.

The markets are based more on sentiment rather than fundamentals. I can work out the rental yield of a property in my head.... I can't do the equivalent for a listed company so buying them is more of a gamble IMO.

I'm assuming some of the retail investors that recently jumped into the market are now discovering Gold and Silver ETF's. The buying trends trend to just move about.

Looking to the post Covid future, there will be another economic shock of some sort unless we've found the magic money tree forever. If that shock isn't health related, how large a stimulus package will Governments be allowed to put out there. They were given free reign this time because the Governments themselves had forced the shutdown. Also, it was global across all countries this time (unprecedented) so everyone started money printing with little fear of ravaging their local currencies too much.

Trump may be long gone by the next economic shock. If markets are tanking and the stimulus is only meagre they will just shrug it off. We are into a strange monetary decade IMO as the rules really have changed.