You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why the world cannot afford the rich

- Thread starter Joe P

- Start date

Rockmeister

pfm Member

see?

Whatever you try to do to make the world perfect,

someone comes along with another idea.

Whatever you try to do to make the world perfect,

someone comes along with another idea.

billo

pfm Member

I have always been a strong advocate of mixing business with pleasure .I was expecting some discussion about progressive taxation, but perhaps I should merge this thread with the watcha cooking’ tonight thread.

Joe

Not Elf and Safety again !!Spot on. How many people have been injured/ killed at work because health & safety was neglected? How about banks that repossess people’s homes? How about the violence of millions starved to death by famine while grain is exported to wealthy countries, who cream off poor countries wealth through foreign debt. How about those millions languishing in prison because they couldn’t afford decent legal representation. And so on and so forth.

A few aristocratic heads falling into a basket can’t compare.

Sue Pertwee-Tyr

Accuphase all the way down

I think we may be cooking up a rebellion.I was expecting some discussion about progressive taxation, but perhaps I should merge this thread with the watcha cooking’ tonight thread.

Joe

Rockmeister

pfm Member

I'd not be in the march if that meal was prepared, but busy gardening as ever and quietly hoping that the bastards got theirs.

I might paint some banners tho?

Or knit scarves for the underdogs if it were winter?

I might paint some banners tho?

Or knit scarves for the underdogs if it were winter?

ks.234

Half way to Infinity

Progressive taxation is not the answer. It has been proposed many times and been defeated each time.I was expecting some discussion about progressive taxation, but perhaps I should merge this thread with the watcha cooking’ tonight thread.

Joe

Low tax has an ideology. Progressive tax doesn't

We need to remove the myth that taxation funds spending. One of the roles of tax is to take money out of the economy after it has been spent into it by government. Fiscal policy can then be employed to manage inflation.

Last edited:

Sue Pertwee-Tyr

Accuphase all the way down

You’d think that if money was in short supply, as our leaders tell us it is, we’d want to ensure our revenue service had all the resources it needed to maximise collection within the rules. It’s almost as though our government is trying to weaken the tax collection regime. I wonder why it might want to do that?I understand that H.M.R.C.'s capacity is being severely taxed by staff shortages.

Cav

pfm Member

Has anyone told the rich?Not your typical lefty paper, this commentary was published recently in Nature, the leading science journal.

Why the world cannot afford the rich

Equality is essential for sustainability. The science is clear — people in more-equal societies are more trusting and more likely to protect the environment than are those in unequal, consumer-driven ones.www.nature.com

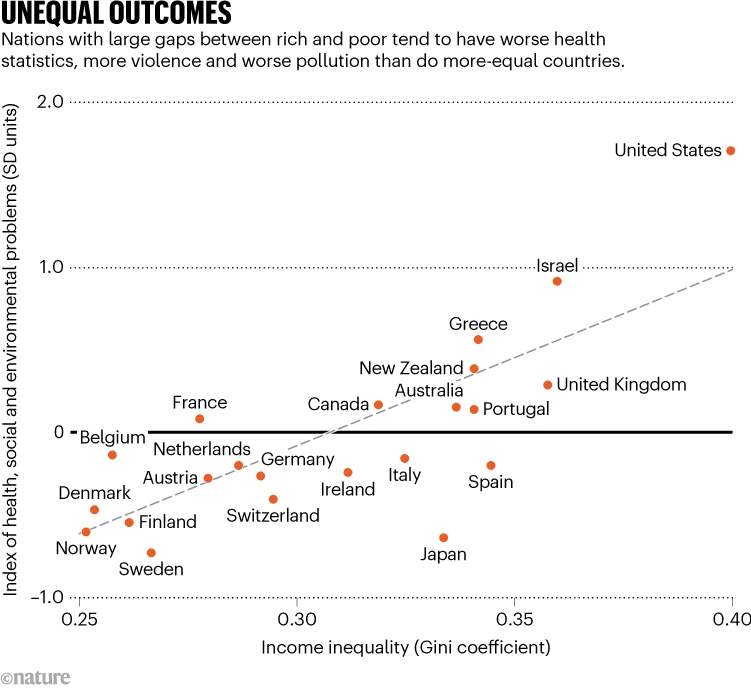

The first two paragraphs and a graph from the commentary —

As environmental, social and humanitarian crises escalate, the world can no longer afford two things: first, the costs of economic inequality; and second, the rich. Between 2020 and 2022, the world’s most affluent 1% of people captured nearly twice as much of the new global wealth created as did the other 99% of individuals put together, and in 2019 they emitted as much carbon dioxide as the poorest two-thirds of humanity. In the decade to 2022, the world’s billionaires more than doubled their wealth, to almost US$12 trillion.The evidence gathered by social epidemiologists, including us, shows that large differences in income are a powerful social stressor that is increasingly rendering societies dysfunctional. For example, bigger gaps between rich and poor are accompanied by higher rates of homicide and imprisonment. They also correspond to more infant mortality, obesity, drug abuse and COVID-19 deaths, as well as higher rates of teenage pregnancy and lower levels of child well-being, social mobility and public trust. The homicide rate in the United States — the most unequal Western democracy — is more than 11 times that in Norway (see go.nature.com/49fuujr). Imprisonment rates are ten times as high, and infant mortality and obesity rates twice as high.

Joe

Bananahead

pfm Member

It's funded by the richHas anyone told the rich?

Mike Reed

pfm Member

I posted in slight jest, but of course the situation is true; to such an extent that HMRC announced last week that they'd close their helpline for 6 months, April to September, allowing more staff to be reallocated. This surprise decision was counteracted by the chancellor within 24 hours, so back to 'normal'. Unfortunately, there's no email facility with HMRC, so telephone and internet are the only communication channels.You’d think that if money was in short supply, as our leaders tell us it is, we’d want to ensure our revenue service had all the resources it needed to maximise collection within the rules. It’s almost as though our government is trying to weaken the tax collection regime. I wonder why it might want to do that?

For such an organisation charged with accurately assessing the ever-increasing tax-paying populace, you'd think the gov't would consider it number one for efficiency and capability. It used to be so nice, convenient and friendly when local access was extant; only a decade ago, too !

ks.234

Half way to Infinity

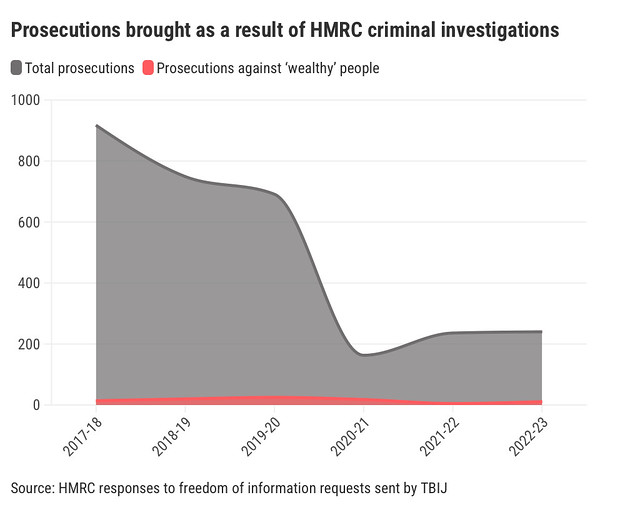

It isn't about accuracy for ordinary tax payers, any mistakes and they will pay. No, the real point is about people who don’t pay. HMRC has less and less resources to tackle tax avoidance by the super rich. Fewer and fewer prosecutions for tax avoiders. Just 11 last yearI posted in slight jest, but of course the situation is true; to such an extent that HMRC announced last week that they'd close their helpline for 6 months, April to September, allowing more staff to be reallocated. This surprise decision was counteracted by the chancellor within 24 hours, so back to 'normal'. Unfortunately, there's no email facility with HMRC, so telephone and internet are the only communication channels.

For such an organisation charged with accurately assessing the ever-increasing tax-paying populace, you'd think the gov't would consider it number one for efficiency and capability. It used to be so nice, convenient and friendly when local access was extant; only a decade ago, too !

Just 11 ‘wealthy’ people prosecuted for tax fraud last year

Critics say the figure suggests HMRC is doing too little to punish rich tax cheats at a time when millions of Britons are struggling to make ends meet

paulfromcamden

Baffled

Increasing 'efficiency' innit.I posted in slight jest, but of course the situation is true; to such an extent that HMRC announced last week that they'd close their helpline for 6 months, April to September, allowing more staff to be reallocated. This surprise decision was counteracted by the chancellor within 24 hours, so back to 'normal'. Unfortunately, there's no email facility with HMRC, so telephone and internet are the only communication channels.

For such an organisation charged with accurately assessing the ever-increasing tax-paying populace, you'd think the gov't would consider it number one for efficiency and capability. It used to be so nice, convenient and friendly when local access was extant; only a decade ago, too !

HMRC 2005 headcount: 104,000

HMRC 2017 headcount: 58,000

Just think how much more efficient it will be if they can get staff levels down to one bloke and a dog.

Apparently it's all going to be done by "bots and AI"

What could possibly go wrong.

Mike Reed

pfm Member

Thinking beyond that, just as we're trying to export asylum seekers to Ruanda at the mo', they'll try to outsource the bots to Botswana.Apparently it's all going to be done by "bots and AI"

It isn't about accuracy for ordinary tax payers, any mistakes and they will pay. No, the real point is about people who don’t pay. HMRC has less and less resources to tackle tax avoidance by the super rich. Fewer and fewer prosecutions for tax avoiders. Just 11 last year

Just 11 ‘wealthy’ people prosecuted for tax fraud last year

Critics say the figure suggests HMRC is doing too little to punish rich tax cheats at a time when millions of Britons are struggling to make ends meetwww.thebureauinvestigates.com

The world hasn't kept up with globalisation, just as it's easy to sell a good product worldwide it's also relatively easy to choose where you pay your tax. What we need is a universal tax rate applied over the planet.

The tax havens don't even work well for most of their residents. I've seen loads of poverty in them, obvs due to the low tax revenues, but many of the workers are on poor wages. You can get a good banker in BVI for £100k enabling them to live very well but the same person needs £250k to live in London.

kensalriser

pfm Member

The purpose of tax havens probably isn't to benefit the ordinary residents of those countries.The world hasn't kept up with globalisation, just as it's easy to sell a good product worldwide it's also relatively easy to choose where you pay your tax. What we need is a universal tax rate applied over the planet.

The tax havens don't even work well for most of their residents. I've seen loads of poverty in them, obvs due to the low tax revenues, but many of the workers are on poor wages. You can get a good banker in BVI for £100k enabling them to live very well but the same person needs £250k to live in London.

Following the end of the Napoleonic War in 1815, the public mood of compliance with income tax rapidly evaporated. The government wanted to retain it to help reduce the National Debt, which by now had swelled to over £700 million. However, strong public opposition to the tax was demonstrated by landowners, merchants, manufacturers, bankers, and tradesmen. It was denounced as 'repugnant' at a large public meeting at Manchester, and almost 400 petitions against it were presented to the House of Commons. Finally, on 18 March 1816, the government was narrowly defeated on the issue and was forced to abandon it.

Those were the days.

Those were the days.

Remind me what they called the first year of the French Republic..? It was more than a few aristos' heads in baskets.Spot on. How many people have been injured/ killed at work because health & safety was neglected? How about banks that repossess people’s homes? How about the violence of millions starved to death by famine while grain is exported to wealthy countries, who cream off poor countries wealth through foreign debt. How about those millions languishing in prison because they couldn’t afford decent legal representation. And so on and so forth.

A few aristocratic heads falling into a basket can’t compare.

That's the problem with revolutions. Once you go around saying "everything must change", some asshole will take you at your word and start destroying the parts of the society that actually functioned. Then some other asshole will decide that the result of the revolution doesn't conform to their specific expectations, and so more people die in order to purge the state of unrevolutionary thoughts (thoughts like "what happened to those rights we were supposed tp have won?"). And who loses most? The poor. Always the poor.

Seeker_UK

Feelin' nearly faded as my jeans

Increasing 'efficiency' innit.

HMRC 2005 headcount: 104,000

HMRC 2017 headcount: 58,000

Just think how much more efficient it will be if they can get staff levels down to one bloke and a dog.

Apparently it's all going to be done by "bots and AI"

What could possibly go wrong.

You can also ad into the mix, 'churn'. On average 10% of CS move department or leave every year, that means each department is not just being shrunk but has one in ten of its workforce in development (ie not fully effective) and in turn takes out staff from doing their 'day job'.

And you can also add vacancies as well. So although current HMRC is running at approx 63000 FTE (https://assets.publishing.service.g...and_payroll_data_for_January_2024.csv/preview) It's more likely to be about 53000 effectively on task.

And then there's the pay. If you're a tax whizz working for HMRC, it won't take long before you can take that skill to the private sector and rake in a lot more than the £50k you get as a Senior Executive in HMRC.