notaclue

pfm Member

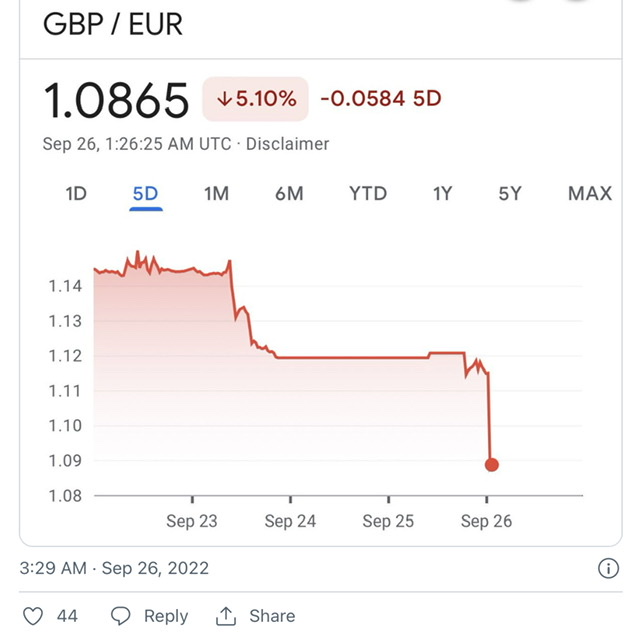

IIt seems every time Kwarteng opens his mouth, the arse falls out of the £ and he’s pledging more tax cuts to come!

Incidentally, I understand that they are planning to update this graph with 'Kwarteng opens his mouth'.

IIt seems every time Kwarteng opens his mouth, the arse falls out of the £ and he’s pledging more tax cuts to come!

Pensions. Don’t panic. If you hold overseas equities, they increase in value if sterling devalues. Many of the top FTSE companies are global with significant USD and overseas earnings.

Agree with this. I'm less certain what it means for fixed income - which will constitute the larger part of many private pensions.

Well, that's what twelve years of Tory does. Now we have 'real conservatism' though, so everything will be fine.Bang on. Far too much cheap money for far too long and too much govt and consumer spending. Here’s the bill.

Many pensions in payment (like mine) are no longer hard wired to inflation. A prolonged period of high inflation will be a disaster for me.

You're talking out of your a h again Ponty...

Hopefully people will realise that govts can’t borrow / QE to their hearts content. It would indeed be bizarre if labour call for a return to the ‘household budget’.

ha ! and Scottish independence and return to the EU would never work because they borrow too much. We should have got out in 2014 before the Tories collapsed the country.I'm so glad we managed to dodge this one anyway, oh wait...

"Analysts predict a crash in the value of the pound if Jeremy Corbyn becomes prime minister"

Now under 1.06 to the Swiss franc - how low can you go?It’s heading for parity with the dollar, it’s being suggested but it’s tanking against the € as well. It seems every time Kwarteng opens his mouth, the arse falls out of the £ and he’s pledging more tax cuts to come!

Don’t buy the propaganda narrative. The £ has crashed because there was zero substance to this government or their budget. It is a budget based purely on gambling, cocaine addled minds, corruption and an ideology that has been proven to fail. It looked stupid and entirely reckless to everyone so it has deservedly been called-out by the markets. It could not be more 21st century Tory.