You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market 2022

- Thread starter Ponty

- Start date

andyoz

pfm Member

S&P500 closes worst first half of year since 1970, at -21%.

And I think Apple has more to fall which won't help S&P. How's Apple going to keep getting gear from China as manufacturing is throttled.

andyoz

pfm Member

More downside to come.

I still think there will be a reversal in the Fed after summer so picking off a few things on the way down.....

sean99

pfm Member

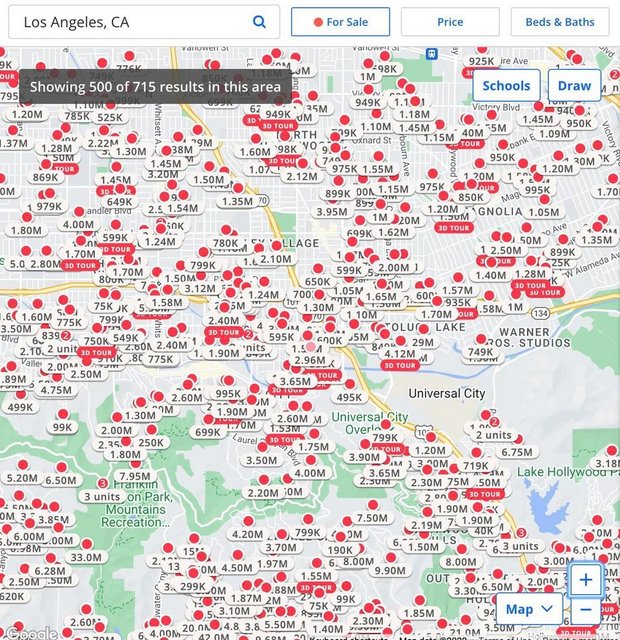

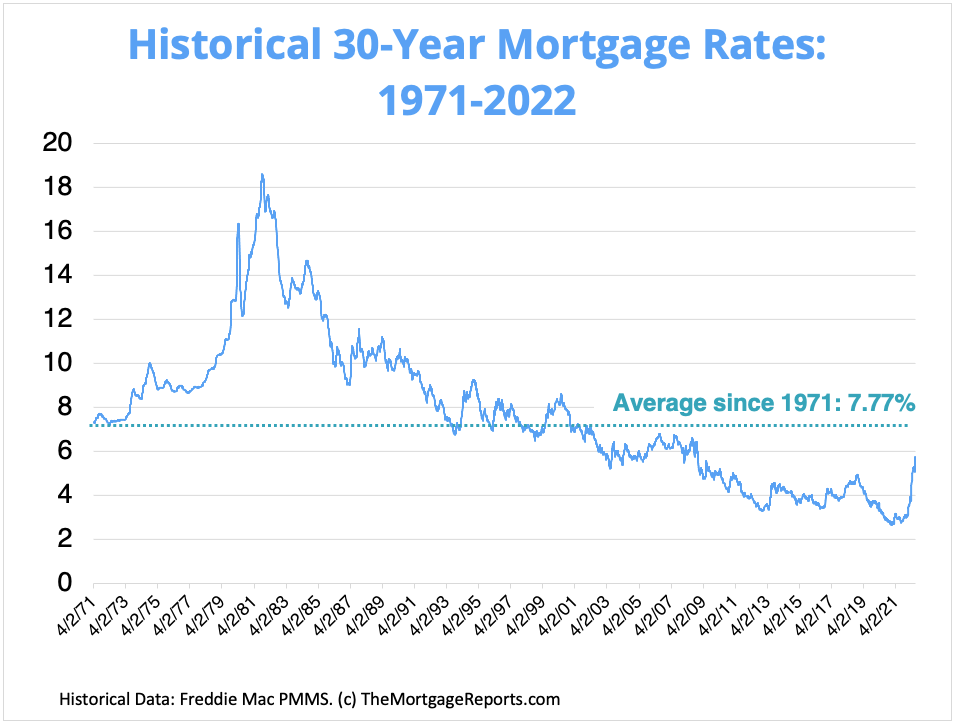

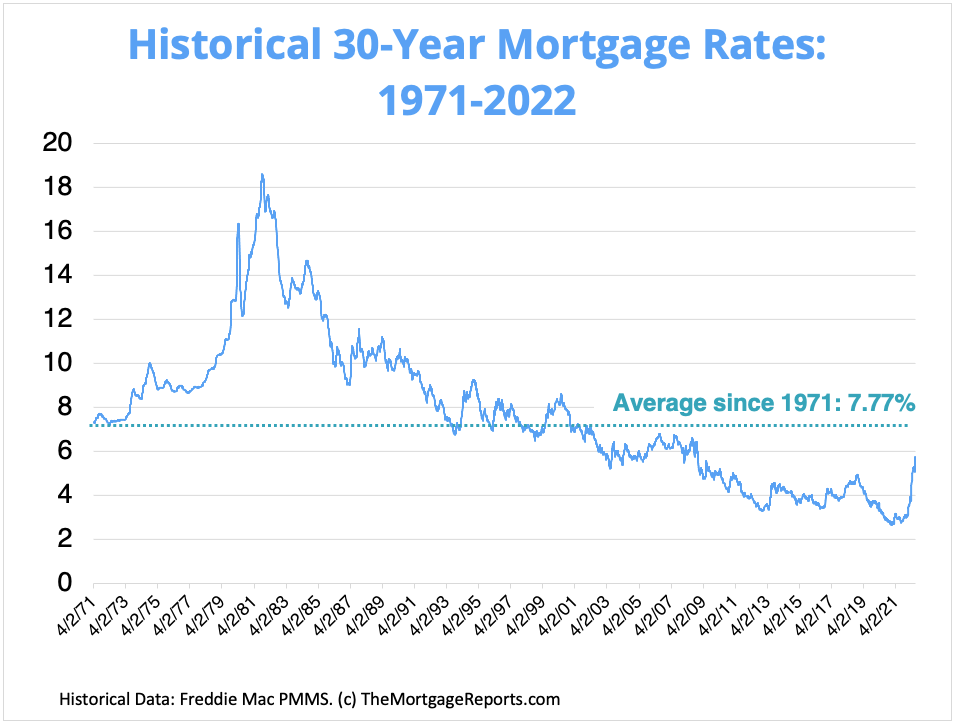

Definitely missed the peak - take a look at the 30yr mortgage rate chart. Looking at my (expensive) town it seems there are still sellers in denial, determined to stay on the market through the summer chasing prices down. In this town if it doesn't sell within 2 weeks it's overpriced.

Source https://themortgagereports.com/61853/30-year-mortgage-rates-chart

Source https://themortgagereports.com/61853/30-year-mortgage-rates-chart

Ponty

pfm Member

Yet there are some folk who don’t agree that house prices are inversely proportional to interest rates.

I do think rates will plummet again at, or probably before, the earliest opportunity. There could also be more stamp duty holidays, re-introduction of MIRAS, longer term / generational mortgages. Plenty of levers yet to pull.

I do think rates will plummet again at, or probably before, the earliest opportunity. There could also be more stamp duty holidays, re-introduction of MIRAS, longer term / generational mortgages. Plenty of levers yet to pull.

andyoz

pfm Member

Yet there are some folk who don’t agree that house prices are inversely proportional to interest rates.

Yes, I've seen that said by many in power too. It's an easy thing to say for decades when the theory hasn't been properly tested...but its about to be...even just for say 6 months

Ponty

pfm Member

Yes, I've seen that said by many in power too. It's an easy thing to say for decades when the theory hasn't been properly tested...but its about to be...even just for say 6 months

It will be interesting to see what the banks do in terms of mortgage down valuing. That could scupper many sales. I agreed a sale (and purchase) in November, which I think was about peak. I sense the property I sold (right out in the sticks) could be a more tricky sell now. Back to the office, rising fuel costs, high maintenance etc, there will just be fewer people who want that type of thing. I didn’t think I’d be able to swap my old place for the geographical area I’m in now without extra cash. The market may have already tipped sufficiently to make that unlikely now, just 8 months on.

paulfromcamden

Baffled

longer term / generational mortgages

I saw No.10 were touting this yesterday. I'm not sure the answer to future generations being able to buy their own home is making them pay off their parent's home first.

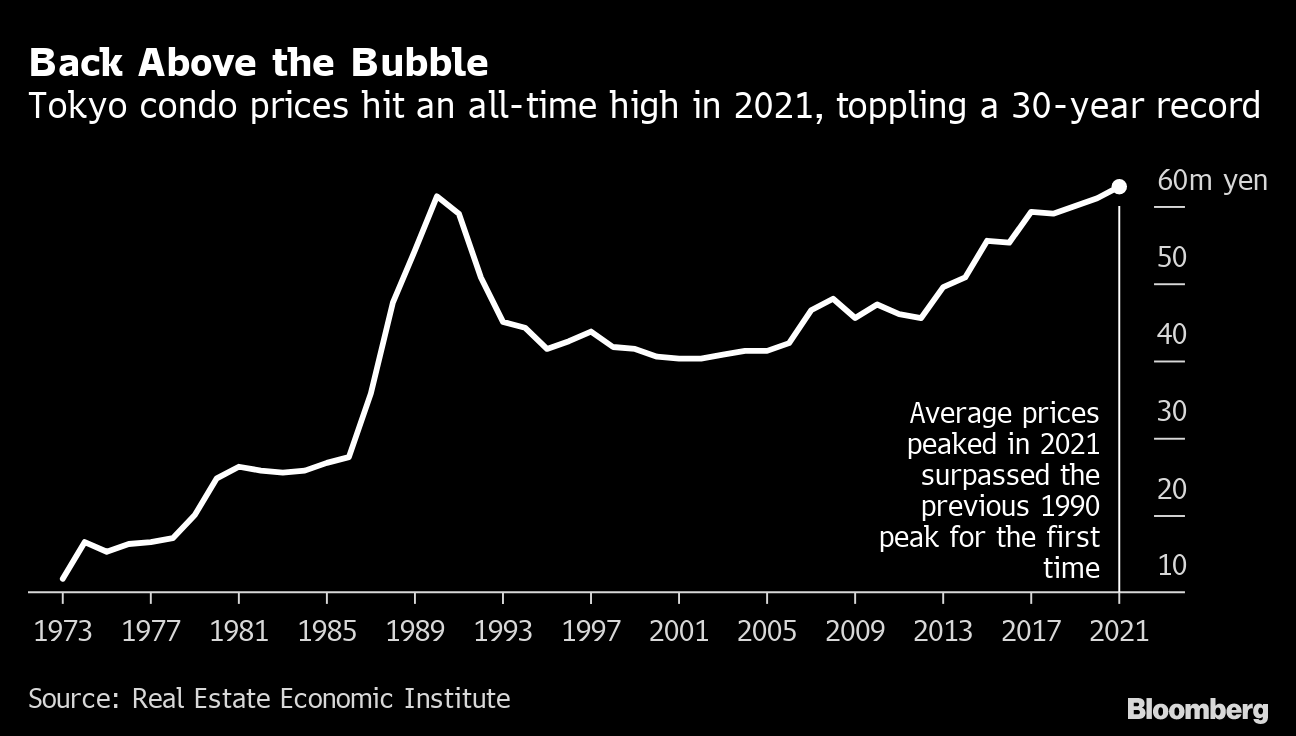

The Guardian article references Japan's 100 year mortgages. A few observations:

1. These were introduced in 1990 just before the bubble burst. Prices have taken 30 years to recover.

2. 100 years mortgages became a vehicle for the rich to avoid inheritance tax:

Such deals represent sound fiscal planning for some families, especially the very wealthy living in Tokyo who, perversely, can almost not afford to inherit a house: Japan's graduated inheritance tax can take up to 70% of a family's assets, including its home. Under the 100-year loan plan, a second generation can move into a deceased parent's home and pay inheritance taxes on only a fraction of the house's value.

https://money.cnn.com/magazines/fortune/fortune_archive/1990/05/21/73567/

3. The Japanese property market is dissimilar to the UK. Japanese residential buildings have a short lifespan. The average age of an apartment is 33 years. New property initially depreciates in value - everyone wants brand new (our Tokyo apartment rent was relatively cheap because it was in an 'old' building - it was ten years old).

One thing that is similar to the UK is a glut of properties where no one wants to live - 8.5 million vacant homes in 2018 with the prediction that a third of all homes in Japan will be vacant in a decade. Unwanted houses in rural areas can be had for £20k.

I still think there will be a reversal in the Fed after summer so picking off a few things on the way down.....

Because inflation will fall?

Definitely missed the peak - take a look at the 30yr mortgage rate chart. Looking at my (expensive) town it seems there are still sellers in denial, determined to stay on the market through the summer chasing prices down. In this town if it doesn't sell within 2 weeks it's overpriced.

Source https://themortgagereports.com/61853/30-year-mortgage-rates-chart

Is there a graph that overlays house prices?

andyoz

pfm Member

Because inflation will fall?

Never say never ...nothing's certain the next few years.

Never say never ...nothing's certain the next few years.

Why do you think the Fed will reverse after the summer?

andyoz

pfm Member

Why do you think the Fed will reverse after the summer?

No particular reason. I've basically decided that doing the exact opposite of what everyone else is thinking/doing seems to work in these volatile times.

andyoz

pfm Member

Why do you think the Fed will reverse after the summer?

You can already see energy prices, oil in particular, falling. That's the sort of shock to the demand side of the equation they wanted... They will use anything they can to soften their stance on the rate of future interest rates rises and maybe a slight reversal.

You can already see energy prices, oil in particular, falling. That's the sort of shock to the demand side of the equation they wanted... They will use anything they can to soften their stance on the rate of future interest rates rises and maybe a slight reversal.

It's impossible to tell at the moment IMO - too many cogs. I think the slight fall in energy prices though is a bit of a false dawn mixed in with some market hopium: structural oil/gas supply problems aren't going to disappear by the end of the summer, and the Saudis don't want to upend their cash flows. To quote the Saudi minister of energy, “the world is running out of energy capacity at all levels.”