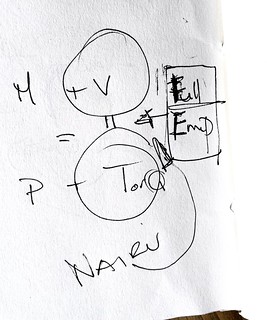

The equation MV=PT originates from classical economics in the 19th century. In a given period the money supply, multiplied by the number of times it is used, equals the price level multiplied by an index of the quantity of goods and services produced. In other words, the total value of money that changes hands (MV) is the same as the money value of goods and services that changes hands (PT).

So you can see that if one of the variables changes, say V increases, then money is being spent more often and that will be reflected in either or both of a rise in the price level and and a rise in goods and services produced.

Monetarists use an assumption, that V (the number of times money changes hands) and T (the quantity of goods and services) are fixed. This is because they assume that an economy is always at full employment. So an increase in the money supply will only have one effect, it will increase the price level. Hence, reduce the money supply to reduce inflation.

Of course, monetarist economies always have mass unemployment so the assumption is invalid and therefore monetarism is invalid, because once you allow for goods and services to be variable, then an increase in money supply increases output. This is typically the case where there is unemployment. The government increases the money supply / issues currency to employ unemployed people, they spend their wages in Tesco who sell more goods so need to employ more people and so on. The money supply is increased and inflation is not the result.