The problems implicit in Gove’s plan are fourfold. If his sales tax is ‘simple’ it will be charged on everything. So get ready to welcome sales tax on food then, for example. This tax is, then, much less likely to be fair then. In fact, we can be sure it will be more regressive: it will be paid in higher proportion by those on low income than high income.

Second, there is no guarantee of there being a tax reduction. A sales tax may be at a lower rate, say 5%, But it is charged right throughout the supply chain. Suppose goods change hands five times before reaching the end consumer. A 5% tax could actually increase end price by more than 27% in that case. Prices matching current VAT are likely. Reductions may well be few and far between. I am not saying there will be none: I am simply saying there will be big winners and losers.

Third, there is the massive bias in favour of imports to consider. Suppose something is made in the UK. By the time everything is assembled, through several layers of supply chain, sales tax of maybe 20% might be included in the price. An almost identical product can, though, be bought from Europe, where they would have VAT still. There would be no VAT charge for the European exporter of that product and they would have just 5% sales tax to pay in the UK. So their product would be substantially cheaper than the UK made equivalent. This tax would then massively undermine UK business and favour imports.

And, fourth, it would also bias against exporters. That's because only the final exporter would not charge the sales tax. All the sales tax on the way through the production process would be a cost. UK exports would, then, be much higher than EU (and other country) equivalent domestically made products. So our exporters would not be able to compete because of Giove's sales tax.

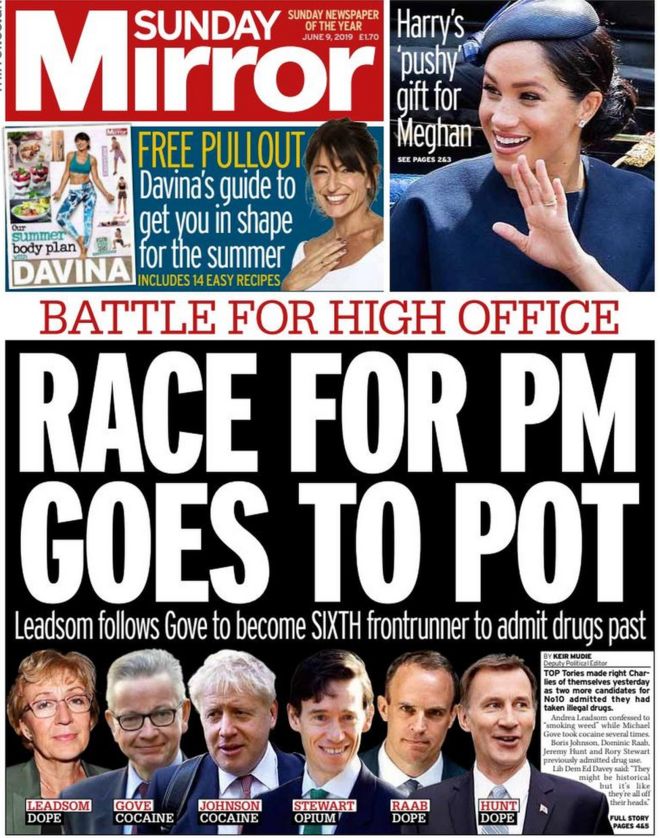

As incompetence in tax design goes suggesting a sales tax takes some beating. But Gove has done it, with a guarantee to destroy British jobs built into the idea. Maybe he was high at the time he thought it worth suggesting. Those who are stone cold sober will not see anything of merit in what he is proposing.