What about our friends across the pond who are something like 30 trillion in the hole, surely that can't be healthy for any economy

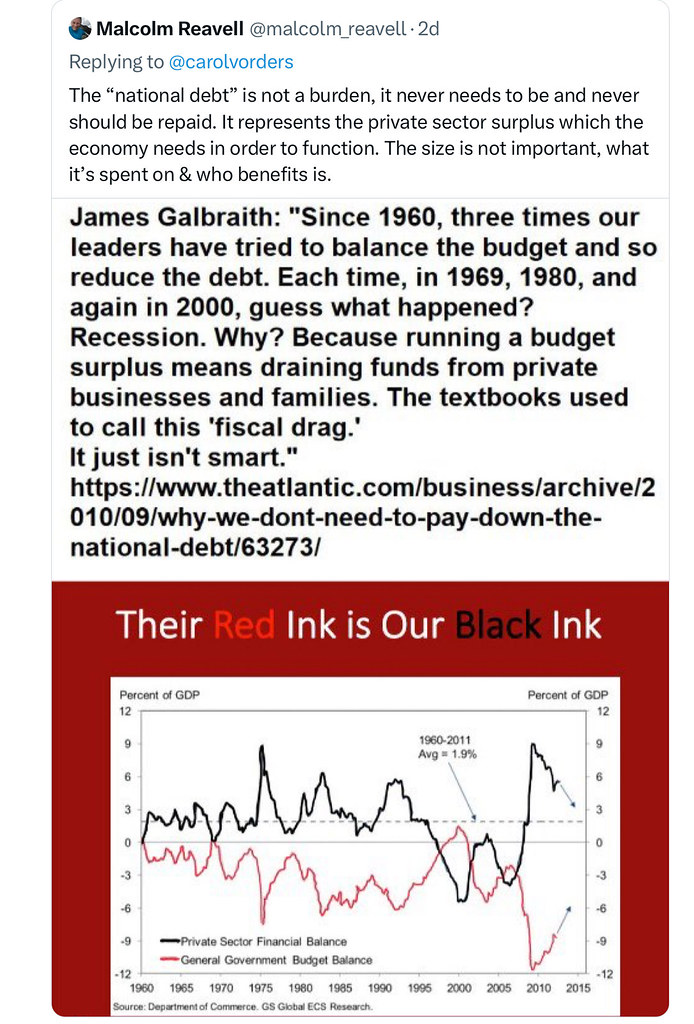

Government “debt” is, in reality, a private sector savings vehicle.

Paying down the debt, as shown by the graph up thread, is bad for the economy, it causes recessions. One reason is that cutting back on public debt, which is sustainable, increases private debt which isn’t.

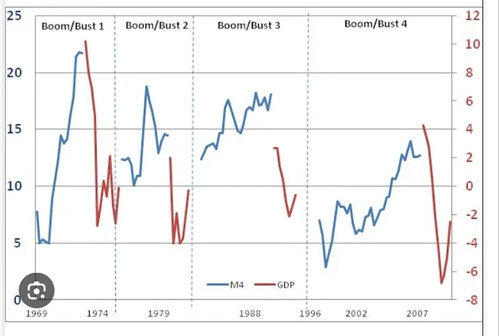

Before every recession since the 70’s there has been a credit boom

Not only is our national debt sustainable, it has, afterall, been around since the Glorious Revolution, paying it down has been the cause of recessions.

The bottom line is that if government wanted to pay off the national debt, it could literally do so at a keystroke, the problem would be that private savings, notably pension providers, would disappear as well.

It should also be remembered that government borrowing, or bonds, are created by government issuance and paid back by government issuance. It is no more than government ‘borrowing’ from itself.

PS. A much better way for government to provide a saving vehicle for pension companies and the like - and to circumvent a lot of the shenanigans of the bond markets with it’s knock on effects to financial markets and speculations - would be for government to provide term deposits, like a 3, 5 or 10 year savings accounts at the BoE. It would achieve much the same ends but without the unnecessary complications and the false narratives.