Seeker_UK

Feelin' nearly faded as my jeans

If all you have is a hammer, everything looks like James Corden's face.

FTFY.

If all you have is a hammer, everything looks like James Corden's face.

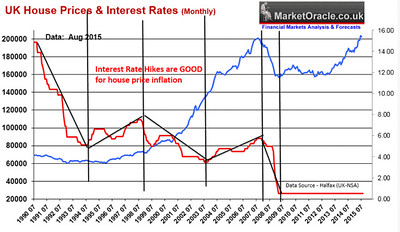

There may not be a strong correlation, but I would argue that low interest rates ENABLE house price inflation. Other factors clearly at play (population growth vs house building, second homes).

Russia and post-covid economic activity have made for the perfect storm.

That was a serious question which deserves more thought than a quick off the cuff response.Ask someone on a low income.

Fixed incomes, all those pension annuities and pension pots that fail to keep up with inflationSo again, what's so bad about inflation?

..the great majority of UK mortgages are now fixed rate, or at least not floating, so increased interest rates will take an age to affect the spending of very many people. Over 90% of personal/private debt in the UK is property/mortgage debt.

Apart from interest rate changes, and unacceptably draconian fiscal manipulation, what else would reduce inflation?

Sorry, but on the cost of housing it is not the case that low interest rates have put up the cost of housing. House prices have risen in times of high interest rates more than they have in times of low interest rates. The less well off have been disproportionately hurt in the housing market because the better off have inflated house prices by buying multiple houses.Cheap money has affected asset values and put up the cost of housing which disproportionately hurts the less well off.

Our current inflation is caused by cost push, not demand pull, so to apply a demand solution to a cost problem shows a lack of understanding of the problem and can only produce, at best, an ineffective solutionMortgages aren’t the only type of loan. Anyone using credit will find themselves squeezed by an interest rate hike, with resulting reduction in demand, which should effect prices by encouraging suppliers to reduce their margins. There’s a lot of consumer credit in the UK post covid.

Yes, I think your first sentence is about right - low interest rates can enable house price inflation, but demand can outstrip supply for many other reasons.There may not be a strong correlation, but I would argue that low interest rates ENABLE house price inflation. Other factors clearly at play (population growth vs house building, second homes).

There is no correlation. House price have risen faster at time of higher interest rates and slower during ZIRPThere may not be a strong correlation, but I would argue that low interest rates ENABLE house price inflation. Other factors clearly at play (population growth vs house building, second homes).

Evidence?They were nonsense, the correlation is screamingly obvious

I’m still left wondering how increased interest rates will help the less well off.

There is no correlation. House price have risen faster at time of higher interest rates and slower during ZIRP

Apparently there are some 600,000 vacant homes in England alone. Wouldn't it be sensible to get those occupied?Unable to post this in the other thread apparently.

One of the many causes of house price inflation but a major one imo is simply a lack of houses. We need to start correcting the situation by building more homes, however, a comprehensive and thought through policy is needed rather than people banging on about their pet agenda of the moment.

Apart from 2008, it shows that house prices have risen during times of high interest rates and low interest rates.

Apparently there are some 600,000 vacant homes in England alone. Wouldn't it be sensible to get those occupied?