ks.234

Half way to Infinity

Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.

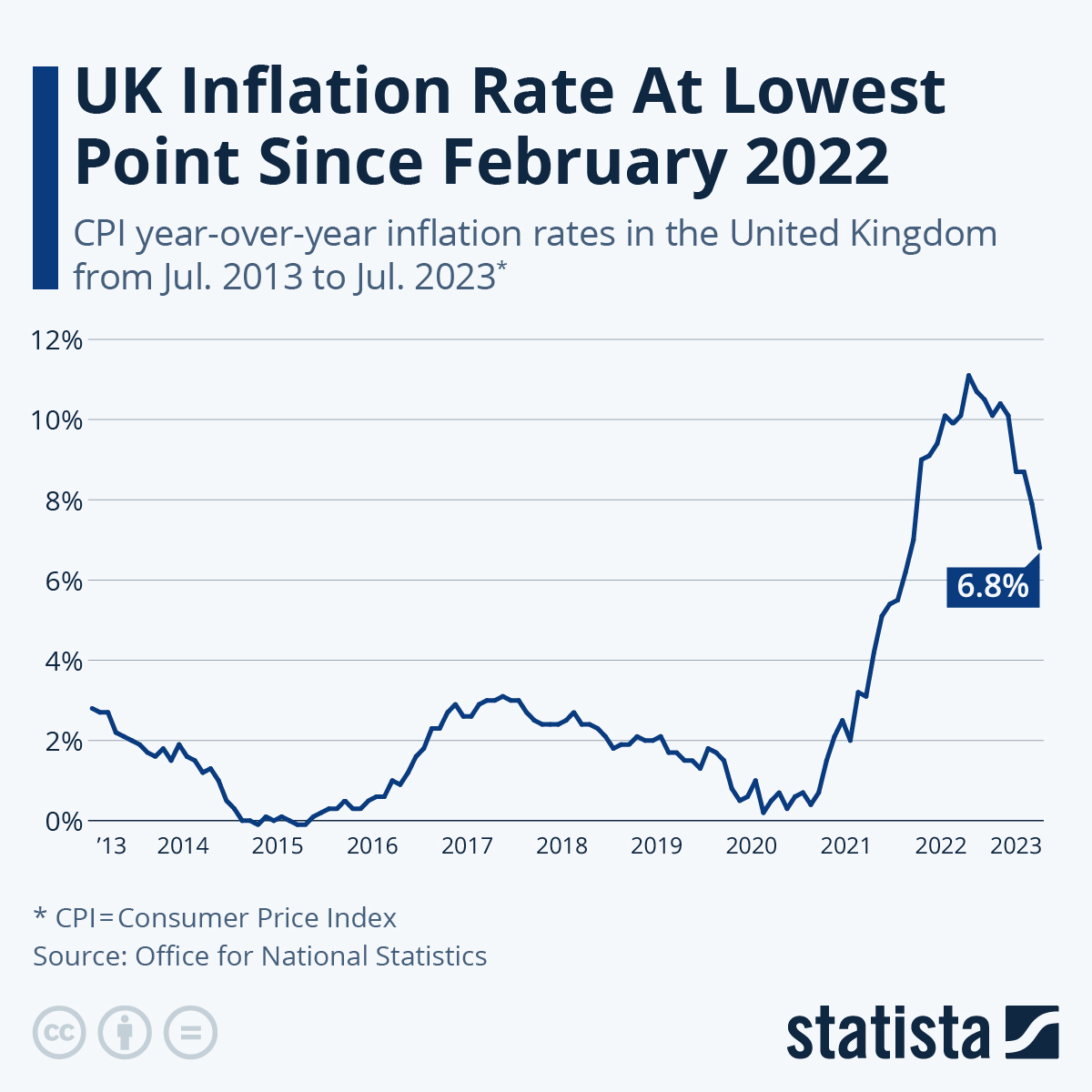

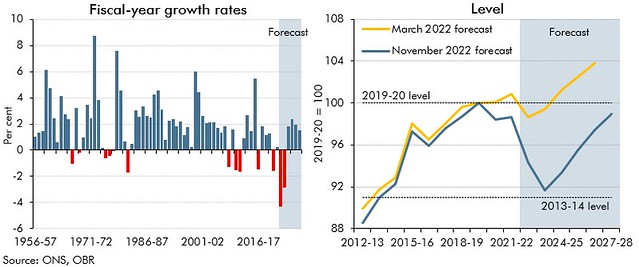

Our only solution to today’s inflation assumes that it is caused by poor people having too much money. Our current conventional wisdom assumes that inflation is always and everywhere cause by poor people having too much money. Which is why the only ever solution is to take money away from poor people and give it to rich people because rich people having more money is not inflationary. Our current economic policy makes no sense, and will only succeed in proportion that it trashes the economy. But it is the current conventional wisdom, so it gets trotted out again and again because no-one is prepared to do anything that does not fit with conventional thinking

Madness, and the sort of madness the will see us heading into a recession.

Two podcasts featuring Warren Mosler explaining the consequences of high inflation and high interest rates and much else besides. Warren Mosler is a founder of MMT, so not for the closed minded. He has however also worked in bond markets, owned and run his own bank, created his own companies selling high end cars and speedboats he himself has designed and is worth a listen for the more curious of mind.

Things really do not have to be this way

https://www.appliedmmt.com/2117653/12701565

https://www.appliedmmt.com/2117653/12701595

John Maynard Keynes

Our only solution to today’s inflation assumes that it is caused by poor people having too much money. Our current conventional wisdom assumes that inflation is always and everywhere cause by poor people having too much money. Which is why the only ever solution is to take money away from poor people and give it to rich people because rich people having more money is not inflationary. Our current economic policy makes no sense, and will only succeed in proportion that it trashes the economy. But it is the current conventional wisdom, so it gets trotted out again and again because no-one is prepared to do anything that does not fit with conventional thinking

Madness, and the sort of madness the will see us heading into a recession.

Two podcasts featuring Warren Mosler explaining the consequences of high inflation and high interest rates and much else besides. Warren Mosler is a founder of MMT, so not for the closed minded. He has however also worked in bond markets, owned and run his own bank, created his own companies selling high end cars and speedboats he himself has designed and is worth a listen for the more curious of mind.

Things really do not have to be this way

https://www.appliedmmt.com/2117653/12701565

https://www.appliedmmt.com/2117653/12701595

Last edited: