Mike Reed

pfm Member

Been there many times and a very pleasant day out but Leeds in Kent would only just qualify as a village; not sure about the slightly larger one in Yorkshire though..The castle has splendid swans.

Been there many times and a very pleasant day out but Leeds in Kent would only just qualify as a village; not sure about the slightly larger one in Yorkshire though..The castle has splendid swans.

Your reference to engineering bricks rather tells the tale. Engineering bricks were only used in the very best properties. The cheaper, less well built, houses have a lower survival rate. At least they do apart from vast swathes of the North where swathes of cheap terraces have survived. Not so many people get dewy eyed about them if they have lived in one.Well, I can't speak for Leeds, but in an approx. 120 year old house the state roof would've been repaired and guttering replaced. DPC would've been engineering bricks but as my 1870 house had them, I guess sth would've been sorted except that they wouldn't've been cavitied; doesn't matter if it's a mid terrace. Underground plumbing in lead? Maybe but surprised it would still be there. If the wiring hadn't been uprated/renewed at least twice it belongs in a museum extolling the virtues of futuristic domestic electricity supply. It may even have been gas lighting at that juncture.

None of this detracts from the solid build, aesthetic attention to detail, capacious rooms and probably a decent loft and garden, prevalent in those times. However, Leeds may've been an architectural entity unto itself, of course.

www.resolutionfoundation.org

www.resolutionfoundation.org

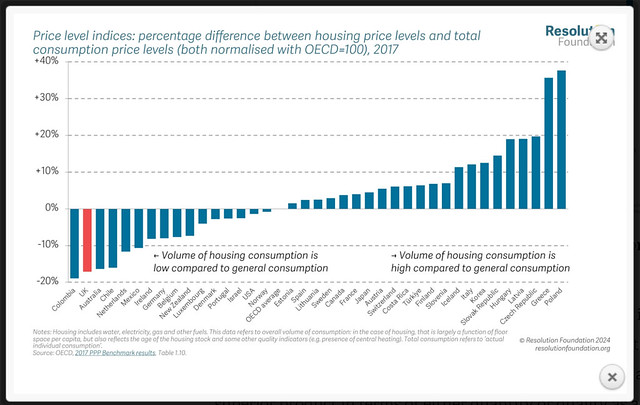

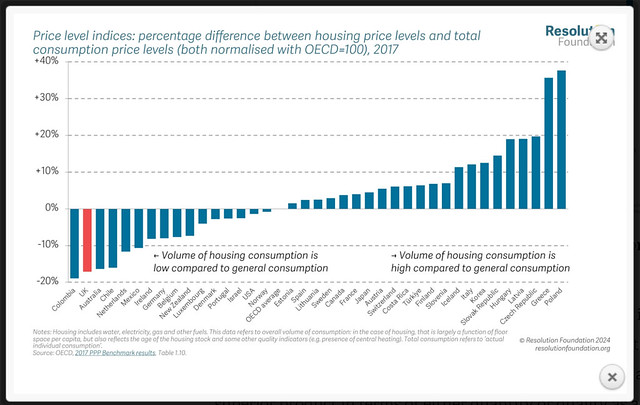

And we thought Brexit was why we lost our Polish plumbers.Housing is more expensive in the UK relative to general prices than in any other OECD country - bar Colombia.

Housing Outlook Q1 2024 • Resolution Foundation

www.resolutionfoundation.org

Been preparing against further govt (of all colours) hostility and assault on landlords. Out with AST’s, in with short term (3 - 6 month) corporate lets. Non housing act contracts with full rent paid up front, so no credit risk. Rents are circa 60% over outgoing AST level (after paying council tax and utilities which are included). No credit check fees, no right to rent checks, no tenant deposit scheme fees, just a straightforward commercial contract between landlord and tenant. Simples, the way it should be. The risk is void periods (for which higher rent compensates), which a good agent should mitigate. Although I’d rather a void than a credit risk / default. An additional benefit is being able to schedule maintenance with tradesmen in advance. I expect more landlords to do similar.

I’m protecting myself against shocking Tory policies. Hardly flying the flag!

Sorry to hear that - I'd wondered recently how you were as you'd been very quiet. Best wishes.Been preoccupied by cancer biopsies.

Not been counting, sorry. Been preoccupied by cancer biopsies. There are a lot of landlords on here so it’s interesting to discuss the trends. Will delete and get back to listening to music.

DittoWish you well -- I hope it was a false alarm.

Me too. As a family, we've been through way too much cancer-related angst. Similar to a fair few others, I'm sure.Wish you well -- I hope it was a false alarm.

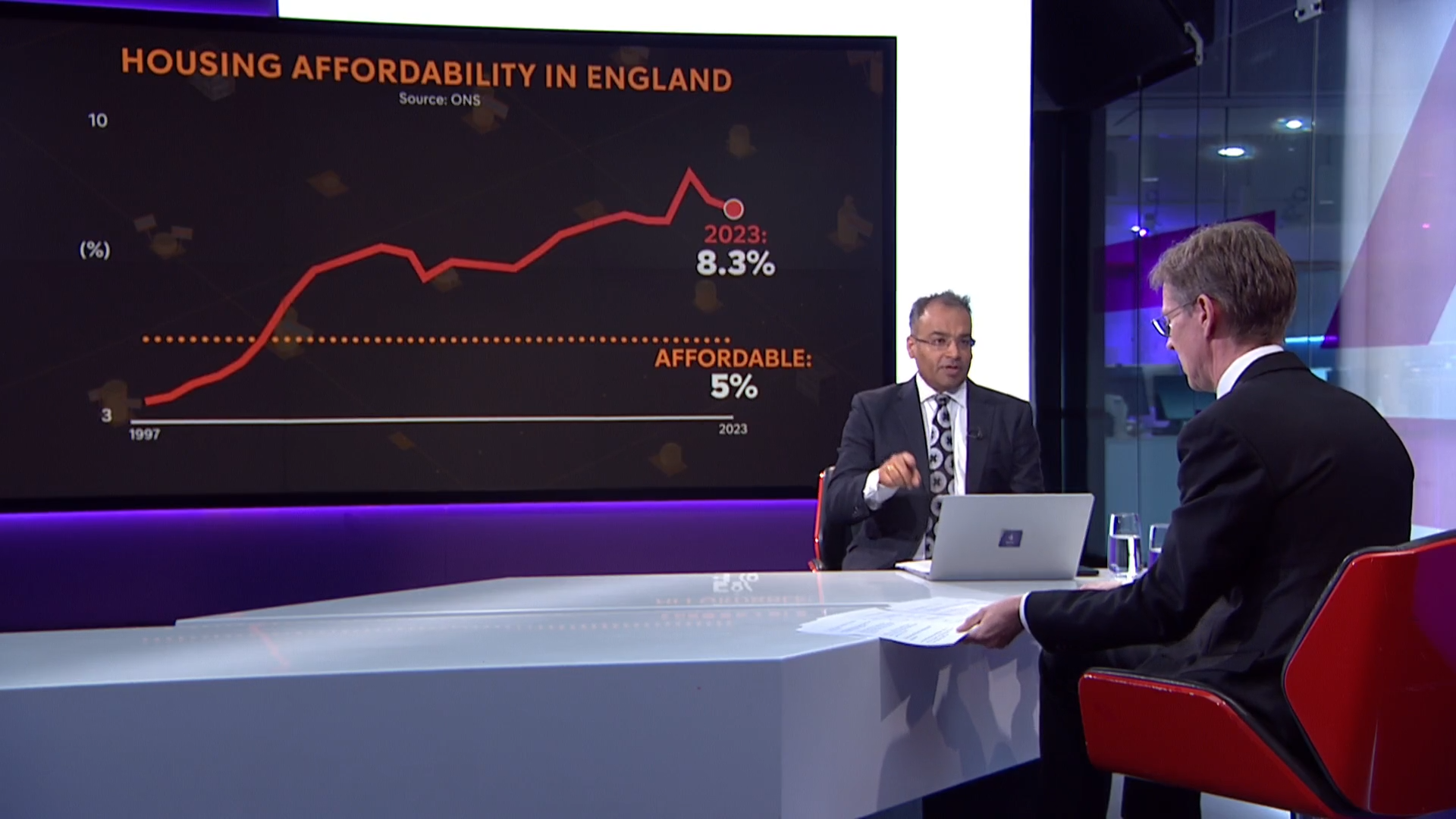

Paul Broadhead, head of mortgage and housing policy at the BSA, said: "Becoming a first-time buyer is possibly the most expensive it has been over at least the last 70 years, but a properly functioning housing market is dependent on first-time buyers being able to afford their first home.

"New thinking and radical changes are needed."

I suspect that the banks know that the market is likely to take a bath at some point in the next year or two, so they don't want to be holding the baby for the repo's where it doesn't recover the loan value when resold. FTBs with 90%+ LTV are most at risk of this.yes . got some FTB struggling at the moment with a house . on open market its worth about 205 -210. they wanted to get a 90% mortgage . offered to them at 190k . however the bank valued it at only 180k meaning they could not get near asking price without a much bigger deposit . they have gone for a 95% mortgage but banks dont help when they give much lower valuations .

True.The bad news is that we are still not building enough new housing and what little we do building tends to be the more 3/4 bed detached stuff because that's where the money lies.

Alternatively, the money that these families raise from selling their parents' houses will allow them to buy bigger houses in the UK. Because we can't live elsewhere in Europe any more, can we?The good news, in the nicest way possible, is that the 60 pluses are now in the dying off cycle and hundreds of thousands of houses will be inherited and then sold off by the 50 year olds and this surplus stock will cause prices to stagnate quite a bit.

I'm not especially old, but I do live in a house bigger than I need. Why? Because I can afford it. Because there is no financial penalty, indeed the capital growth since I bought my house is effectively paying me £20-25k a year that I wouldn't earn if I lived in a cave. I have a decent pension fund, but I wish that it had increased in value by as much as my house over the last 9 years. I'm being paid to live in a nice house in a nice area. Who would turn that down? With this in mind, do you think it's going to stop just because a few oldies die?The main problem currently is old couples and singles living in 3 or 4 bedroomed houses which means millions of bedrooms permanently being empty. Once they are dead and gone, we are back to the market of the 1970s.