Colin

The state pension has always been rubbish and will almost certainly continue to be rubbish therefore you need to make your own pension provision unless you want to retire in poverty. My state pension is £160 pw and no one can live on that.

There is nothing sadder than seeing a retired person sitting in a bus, using a bus pass to while away the time.

Retirement is for lots of foreign travel, eating out in many restaurant and indulging in your whims which often cost money such as buying that Harley you promised yourself . Also you got to spend more time on looking after your health, so whether you like it or not, you got to go private a lot more often because you don't want to hang about for 6 months to have an op when you are dodging your coffin.

The alternative is to sit in your house, not redecorating or updating it due to the expense, not replacing the car, wearing the same old clothes and taking a week off to visit Blackpool or some other such shithole. In other words you are making do with what you already have and slowly using up your savings.

That is not how you should be spending the last 15 years of your life.

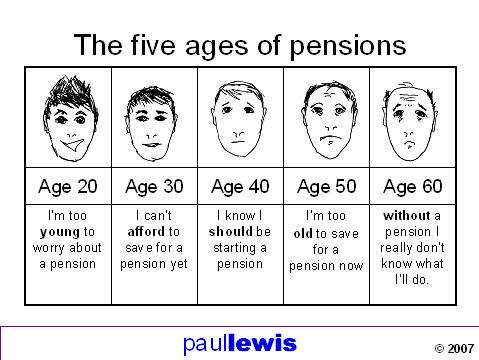

Therefore start making provision as from today, don't think about it, just do it.

Regards

Mick