paulfromcamden

Baffled

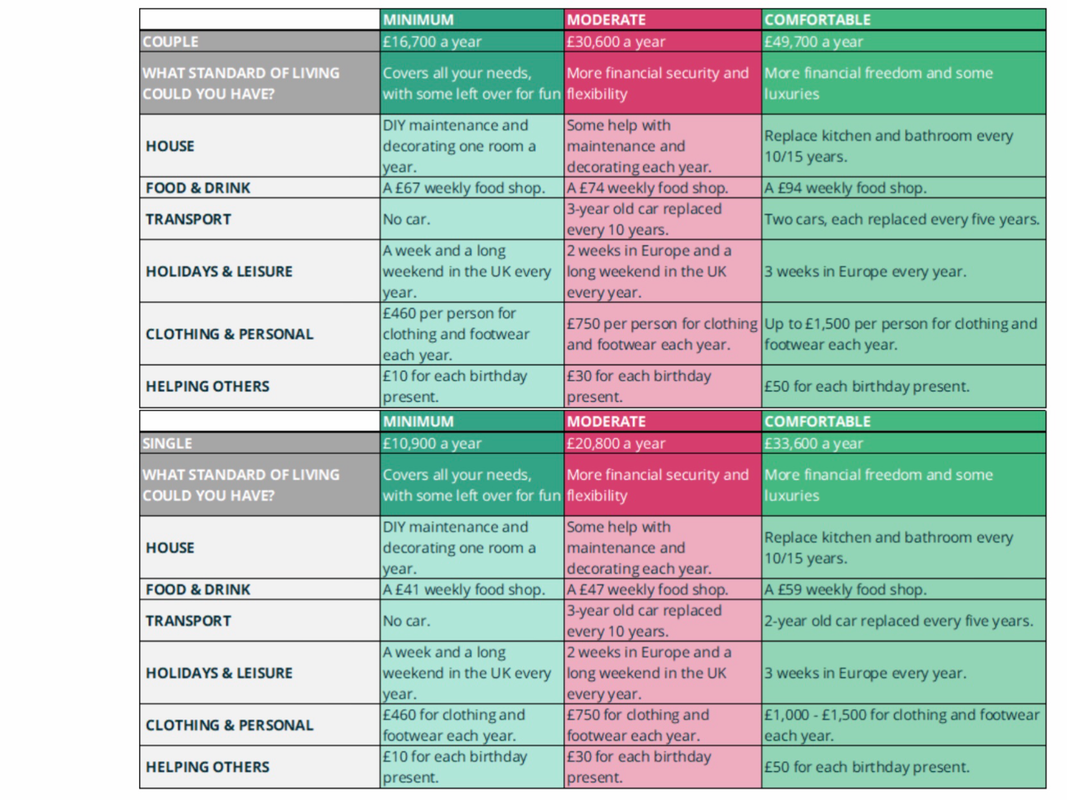

If nothing else, that report is a sobering thought for people in their 20’s/30’s who are starting out in retirement planning.

State pension (in whatever form it exists) plus, say, £30k private pension. I guess a £1m pot would be needed to cover it. Not going to happen for most people.