PsB

Citizen of Nowhere™

You're cherry picking your dates a bit. If we were to look at house prices throughout the 60s, 70s and 80s, my guess would be we would find some correlation.But UK house prices have not increased with inflation. UK inflation has been around 2% since 1993, and did not go above 2% again until July 2021. In that time house prices have increased significantly.

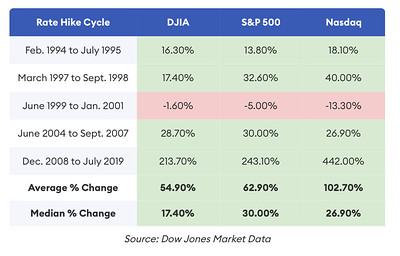

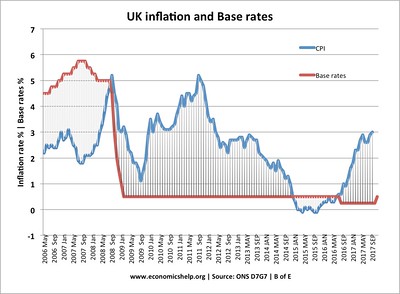

If you remove the two minor events called WW1 and WW2, the correlation looks pretty good to me.Further, although the received (Tory) wisdom might be that inflation brings higher interest rates (which might explain why Tories see raising interest rates as the only tool to tackle any inflation) if you take a long view of the relation ship between inflation and interest rates….

…the correlation is not strong.

True, the correlation looks stronger if you only look at the 50 years before the 2008 crash, but it starts to look rather weaker again after it

Here again, there was the Great Financial Crisis in there. We're still living with the consequences of that and the factors that created it.

I feel that is simplistic. BTL landlords (not poor) love low interest rates because they get to feel like financial geniuses. Most people depend on interest rates being above 0 for their pensions and all sorts of other things. Inflation is a tax levied by the salaried on the inactive, and most of the inactive are not the idle rich. One of my favourite conspiracy theories is the one that Boomers, having enjoyed the benefits of inflation all through their working lives (to increase their salaries and erode their mortgages), lobbied hard to bring interest rates down to 0 after they retired, to make sure they could hold on to their pensions and small-to-middling assets. They're a selfish lot, boomers.Interest rates are regressive. The benefit lenders who tend to be richer at the expense of borrowers who tend to be poorer. To raise interests rates to control inflation is a Tory tool that will only make inflation worse because it will make the gap between prices and peoples ability to pay greater.