Nick_G

pfm Member

"We asked 100 people to name something that grows. You said pie...."

Tumours as well.

"We asked 100 people to name something that grows. You said pie...."

Obviously, the economy is not the housing market.

And again you need to put forward your alternate policy. Interest rates are stuck at zero. We have a decade+ of near zero growth. What is your suggested monetary policy?

Note, by the way, if you wanted fiscal policy to take up the slack as we reached the limits of monetary policy welcome to the club you are now a dangerous lefty.

People may find some of this interesting as a sidelight on what he have now reached in terms of Government economic 'policy' and the impact of what the press present as reality, etc.

https://www.bbc.co.uk/programmes/m001cdnt

Don’t make things up just to suit your outlook please Ponty. Murphy doesn’t talk about printing money, or allowing currency and inflation to run free?I’m sure he’d be great in a hard left govt, he certainly seems to get very involved in politics for an economist, so why not! He’d keep IR’s on the floor and not worry about the currency (it’s value or how much is printed) or inflation. Get him in!

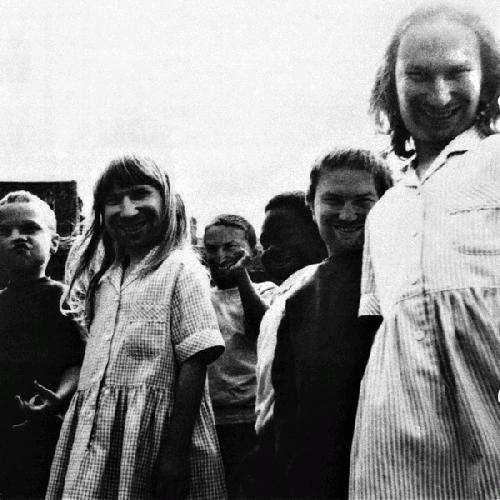

Chris Cunningham made some superb videos.Aphex Twi...err Triplet

Don’t make things up just to suit your outlook please Ponty. Murphy doesn’t talk about printing money, or allowing currency and inflation to run free?

It’s not but if people see 10%+ year on year from houses and a one way bet, why would they invest in alternatives with greater perceived risk? Just buy more houses, which further perpetuates the issues. ZIRP was an ‘emergency’ response to the GFC and should have been treated as such, not the new normal. Wages didn’t need to grow with ZIRP, everything just became financialised, cars, phones, 0% credit cards etc, ultra low cost debt meaning people could service the monthlies.

That’s exactly what he was saying he’d do in a plan with Blanchflower. Was on a link Tony posted.

If you mean the twitter link, then, no.Don’t make things up just to suit your outlook please Ponty. Murphy doesn’t talk about printing money, or allowing currency and inflation to run free?

Neither, by the way, is he hard left. Though if he was, he couldn’t possibly be worse than the hard right goons that you have been voting for all this time and who have led us into this immoral economic dead end

Russ should be the BBC News at 6 and 10 Anchor.Russ Jones with a much needed Tory conference report #TheWeekInTory.

Perhaps my favourite line:Russ Jones with a much needed Tory conference report #TheWeekInTory.

I don’t know, Ponty doesn’t seem wrong hereWages didn’t need to grow with ZIRP, everything just became financialised, cars, phones, 0% credit cards etc, ultra low cost debt meaning people could service the monthlies.

Here's a left-wing think tank's paper on low interest rates and productivity: 'Our most important finding was that extraordinary monetary policy has very little direct effect on firm-level investment strategies'.I don’t know, Ponty doesn’t seem wrong here? Good orthodox Marxist analysis. Also, don’t ask me for receipts but I’m sure I’ve read stuff pointing to the negative effects of low interest rates on productivity. A lot of what Ponty’s been saying seems reasonable, once you substitute “large corporations” for the spendthrift plebs he no doubt has in mind.

Ukranian comedian on R4 :- "Comedy always helps, perhaps that why we elected a comedian as president - maybe that`s why you did too?"