You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market 2022

- Thread starter Ponty

- Start date

NeilR

pfm Member

BG funds / trusts getting whacked. Anyone else topping up for the long haul?

Yeah, I noticed. but it is not a surprise with them being out and out growth investors. higher inflation/interest rates are bad for growth stocks.

I am not topping up any BG yet. Planning to add to Fundsmith Equity this year on the dips though.

andyoz

pfm Member

BG funds / trusts getting whacked. Anyone else topping up for the long haul?

No, been having too much fun with Easyjet and me old friend CINE !!!

davidsrsb

pfm Member

Strangely Bowie's estate is reported to have not made half of this. OK BS is still alive, but I cannot see him getting many fresh hitsYes, my thoughts exactly.

Bruce has essentially said...There you go...now get your $550m back somehow as I'm sure his advisers are busy investing it elsewhere in something more diversified.

Smart move and many of these recent deals smack of too much 'cheap' money floating around the world (for now)...

Ponty

pfm Member

Yeah, I noticed. but it is not a surprise with them being out and out growth investors. higher inflation/interest rates are bad for growth stocks.

I am not topping up any BG yet. Planning to add to Fundsmith Equity this year on the dips though.

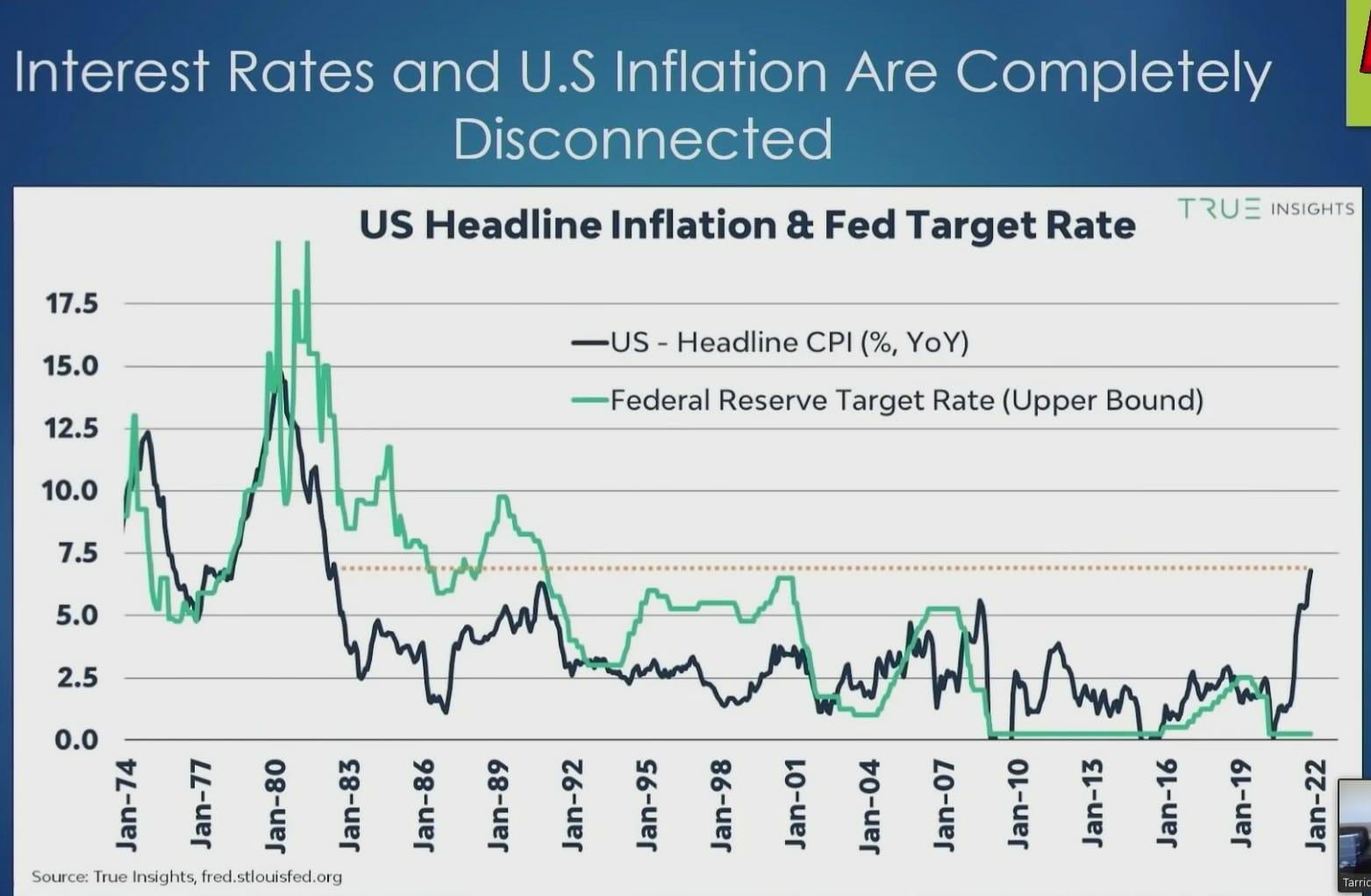

Yep, but these things are always overdone, on the way up and down. I really question how far rates can rise. They ‘should’ be 5%+ but no chance of that whatever inflation does, there is too much debt everywhere, govts included. Might see 1 - 1.5%, still amazingly cheap money. I still believe that technology hasn’t really got started, we just don’t know what’s possible and how this will change our lives over the next 20 years. When you cast your mind back 20 years in terms of tech, it’s quite scary.

NeilR

pfm Member

Yep, but these things are always overdone, on the way up and down. I really question how far rates can rise. They ‘should’ be 5%+ but no chance of that whatever inflation does, there is too much debt everywhere, govts included. Might see 1 - 1.5%, still amazingly cheap money. I still believe that technology hasn’t really got started, we just don’t know what’s possible and how this will change our lives over the next 20 years. When you cast your mind back 20 years in terms of tech, it’s quite scary.

Yes I agree. I am not selling any positions, just not topping up until the sector has fully shaken out.

Tony L

Administrator

Strangely Bowie's estate is reported to have not made half of this. OK BS is still alive, but I cannot see him getting many fresh hits

No idea about sales, and that is what this will be based on, but I suspect Springsteen has a lot more global appeal. Bowie (whilst exponentially superior to my mind) was possibly quite a localised UK market in comparison. I don’t think he ever broke the US to the degree say The Beatles or Led Zeppelin did.

andyoz

pfm Member

Yep, but these things are always overdone, on the way up and down. I really question how far rates can rise. They ‘should’ be 5%+ but no chance of that whatever inflation does, there is too much debt everywhere, govts included. Might see 1 - 1.5%, still amazingly cheap money. I still believe that technology hasn’t really got started, we just don’t know what’s possible and how this will change our lives over the next 20 years. When you cast your mind back 20 years in terms of tech, it’s quite scary.

I hadn't noticed how far they had dropped, might top up soon as last bought in Spring 2021 when they really tanked (and someone here pointed that out!).

NeilR

pfm Member

I hadn't noticed how far they had dropped, might top up soon as last bought in Spring 2021 when they really tanked (and someone here pointed that out!).

buy some ARKK, you know you want to!

Ponty

pfm Member

I hadn't noticed how far they had dropped, might top up soon as last bought in Spring 2021 when they really tanked (and someone here pointed that out!).

I’ve noticed these routs tend to last a week, so will keep an eye on tomorrow. Gold miners have dived as well.

Strangely Bowie's estate is reported to have not made half of this. OK BS is still alive, but I cannot see him getting many fresh hits

Bowie is esoteric and English. The Boss is mainstream and American. Probably outsold (records and concerts) Bowie at least 1 to 2.

Heckyman

pfm Member

BG funds / trusts getting whacked. Anyone else topping up for the long haul?

No -- been checking my stop losses, any signs of real trouble and I'm out. It's turning into the wild west out there and I feel like retail investors are gonna be left holding the bag -- too much for me!

Did recently add to BP and Lloyds for a short term play, no US growth exposure here...

Vietnam funds VNH and VOF working well, up around 8% last month with no drama...I would maybe consider buying dips on VNH.

Heckyman

pfm Member

No, been having too much fun with Easyjet and me old friend CINE !!!

Good luck! 20% up in a few days is good going...

andyoz

pfm Member

Good luck! 20% up in a few days is good going...

Yeah, CINE has tortured me in the past so I should learn but can't resist. It's manipulated to fook that one!

Easyjet on the other hand, at sub 500 was a pretty asymmetric bet IMO.

Ponty

pfm Member

andyoz

pfm Member

"In 2021 we saw the average house price reach new record highs on eight occasions, despite the UK being subject to a 'lockdown' for much of the first six months of the year.

"The lack of spending opportunities afforded to people while restrictions were in place helped boost household cash reserves."

News Shock: Covid support money ends up in housing market...that's a nice productive place for it

andyoz

pfm Member

What’s even worse is that the covid support money didn’t exist, it had to be printed, further compounding the consequences we see today. It’s all a very convenient bit of upside for the govt, their #1 economic priority seems to be house price growth.

Definitely a winner with the younger voters who have been hung out to dry...