You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market 2020

- Thread starter andyoz

- Start date

- Status

- Not open for further replies.

robs

should know how this works by no

Bloomberg:

"We’re not even thinking about thinking about raising rates,"

“We are strongly committed to using our tools to do whatever we can for as long as it takes.”

"The Federal Open Market Committee earlier said it would increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities “at least at the current pace” to sustain smooth market functioning.

A related statement from the New York Fed specified that the pace of the balance-sheet increase would be maintained at about $80 billion a month for purchases of Treasuries and about $40 billion of mortgage-backed securities."

So if I am understanding that correctly, a third of the spend is going on propping up property lending...? Haven't bothered to look but wonder where the credit rating agencies are now?

I am thinking Zimbabwe...

DJ down 1%...

"We’re not even thinking about thinking about raising rates,"

“We are strongly committed to using our tools to do whatever we can for as long as it takes.”

"The Federal Open Market Committee earlier said it would increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities “at least at the current pace” to sustain smooth market functioning.

A related statement from the New York Fed specified that the pace of the balance-sheet increase would be maintained at about $80 billion a month for purchases of Treasuries and about $40 billion of mortgage-backed securities."

So if I am understanding that correctly, a third of the spend is going on propping up property lending...? Haven't bothered to look but wonder where the credit rating agencies are now?

I am thinking Zimbabwe...

DJ down 1%...

sean99

pfm Member

Bloomberg:

"We’re not even thinking about thinking about raising rates,"

“We are strongly committed to using our tools to do whatever we can for as long as it takes.”

"The Federal Open Market Committee earlier said it would increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities “at least at the current pace” to sustain smooth market functioning.

A related statement from the New York Fed specified that the pace of the balance-sheet increase would be maintained at about $80 billion a month for purchases of Treasuries and about $40 billion of mortgage-backed securities."

So if I am understanding that correctly, a third of the spend is going on propping up property lending...? Haven't bothered to look but wonder where the credit rating agencies are now?

I am thinking Zimbabwe...

DJ down 1%...

Yes - in the US of A we believe in capitalism, but, by God we can't allow price discovery, because, well, that would be a calamity.

davidsrsb

pfm Member

Many did not, Pets.comIt actually worked out OK as I kept my job and was granted options at single figures!

NeilR

pfm Member

I know of people who remortgaged their house to buy more and more tech stocks on the way up in 99, then BANG!! They were in Ireland as well so the house was suddenly worth £4.50 as nobody had a job.

A colleague once told me of a friend of his who worked at ARM holdings back during the tech bubble who had shares in the company worth hundreds of thousands of pounds from the company SAYE scheme. When the shares matured, he sold them all and bought a selection of tech company shares.

The tech bubble then burst and with it the value of all of his newly purchased shares. He then received a six figure capital gains tax bill for the sale of the ARM Holdings shares. But of course, the tech shares he now owned were worthless.

I think it bankrupted the guy.

Snufkin

pfm Member

For a moment I read that as Beer Market Rally - now that would be dangerous as I had visions of multitudes of private investors stuck at home, hitting the beer and going on mad stock buying sprees.Bear market rally...very dangerous

andyoz

pfm Member

One lady on the Robinhood.com trading platform chat room asked that if she bought shares and the value went down, could she just return them for a refund (like you return a dress to a shop unworn)

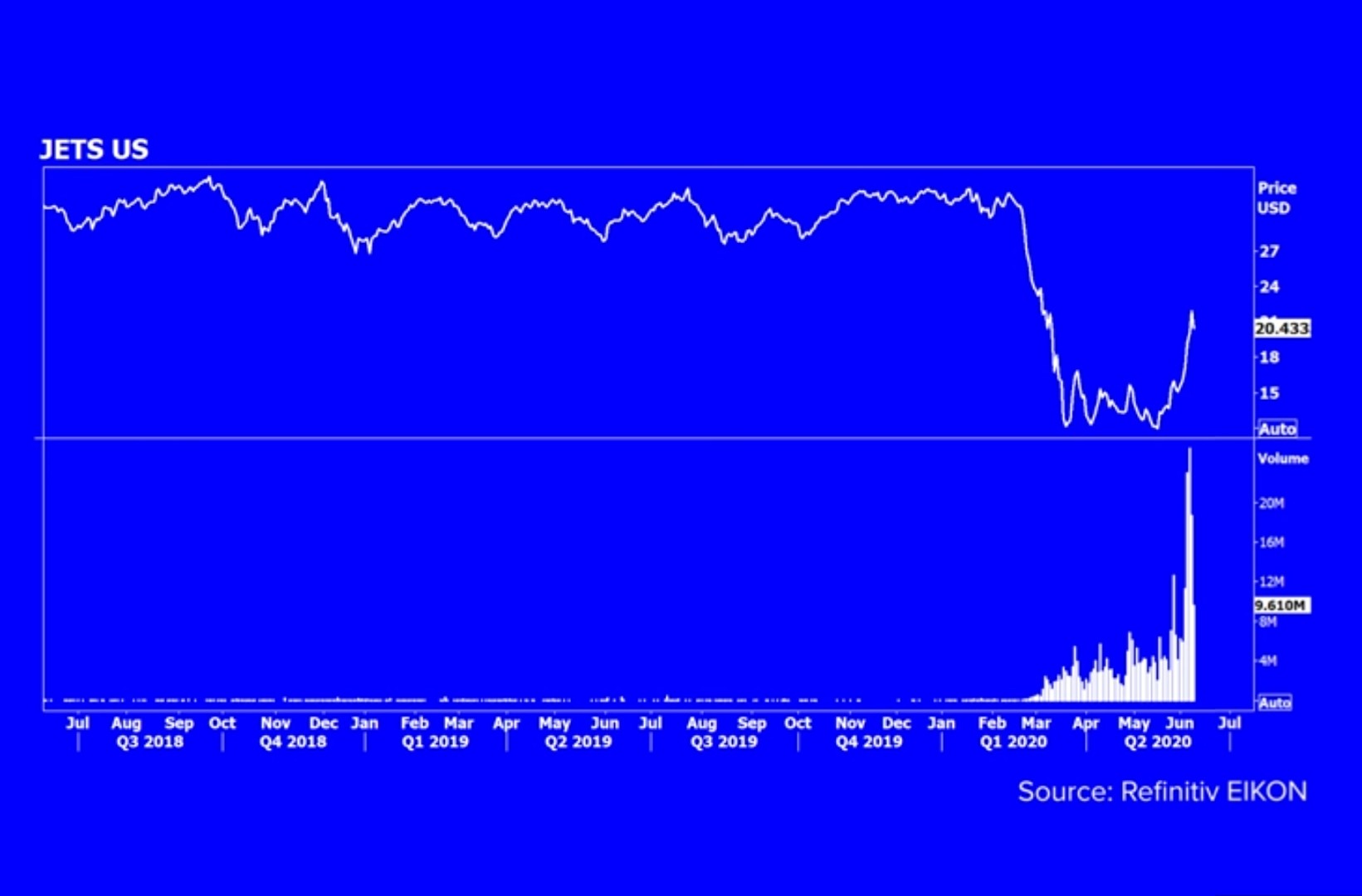

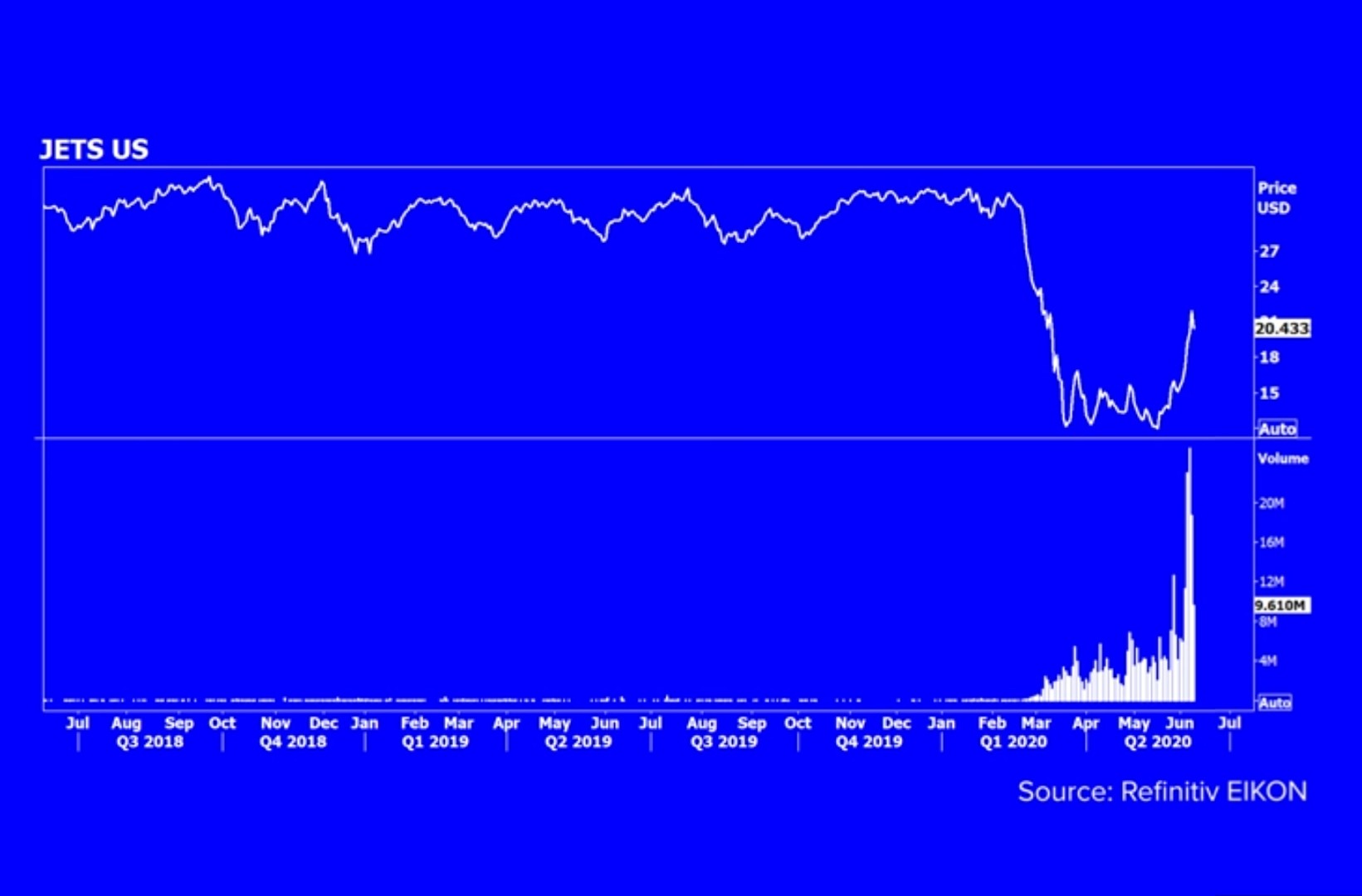

Here's the surge in trading volume that's been typical of many stocks . This one's a US airline ETF who's trading volumes went from 1 million a day to 20 million a day the last week. Powell's comments about 'unlimited' support has created a monster here in the retail investors....

Here's the surge in trading volume that's been typical of many stocks . This one's a US airline ETF who's trading volumes went from 1 million a day to 20 million a day the last week. Powell's comments about 'unlimited' support has created a monster here in the retail investors....

Last edited:

andyoz

pfm Member

I'll bet the US markets start to rollover the second half of this month...lots of strange thing happen the end of each quarter...

I doubt many of the new investors are yet to lose any money so will be interesting to see the fear psychology play out when they do.

..and looks like cases are starting to surge again in the US (here too soon)...now that's a surprise!!

https://www.theguardian.com/world/2020/jun/09/coronavirus-cases-uptick-detected-some-us-states

I doubt many of the new investors are yet to lose any money so will be interesting to see the fear psychology play out when they do.

..and looks like cases are starting to surge again in the US (here too soon)...now that's a surprise!!

https://www.theguardian.com/world/2020/jun/09/coronavirus-cases-uptick-detected-some-us-states

Last edited:

andyoz

pfm Member

Here we go maybe...

FTSE down 4% at the close and DJ down >5% now.

Tomorrow might be interesting.

There are some important end of quarter dates to come yet too...wait for the Monday after the third Friday of the final quarter month...maybe investors aren't as certain about their positions as they first thought. Maybe they are actually researching valuations and realise the Fed can't prop this forever...

Meanwhile the Institutional investors would have been shorting away to hedge against this - they win either way and the retail ones don't know what hit 'em...

andyoz

pfm Member

That is some selloff todayProbably see it back up 5% tomorrow, can't let the tradees have a glum weekend.

Dow down near 10% in two days.

Fed..better up your game lads!

robs

should know how this works by no

"The Federal Reserve is wrong so often. I see the numbers also, and do MUCH better than they do. We will have a very good Third Quarter, a great Fourth Quarter, and one of our best ever years in 2021."

POTUS tweet a few hrs ago.....good, everything's OK then, he confirms it.

POTUS tweet a few hrs ago.....good, everything's OK then, he confirms it.

andyoz

pfm Member

"The Federal Reserve is wrong so often. I see the numbers also, and do MUCH better than they do. We will have a very good Third Quarter, a great Fourth Quarter, and one of our best ever years in 2021."

POTUS tweet a few hrs ago.....good, everything's OK then, he confirms it.

Dow only fell 800 points since he said that so he can predict the future!

- Status

- Not open for further replies.