andyoz

pfm Member

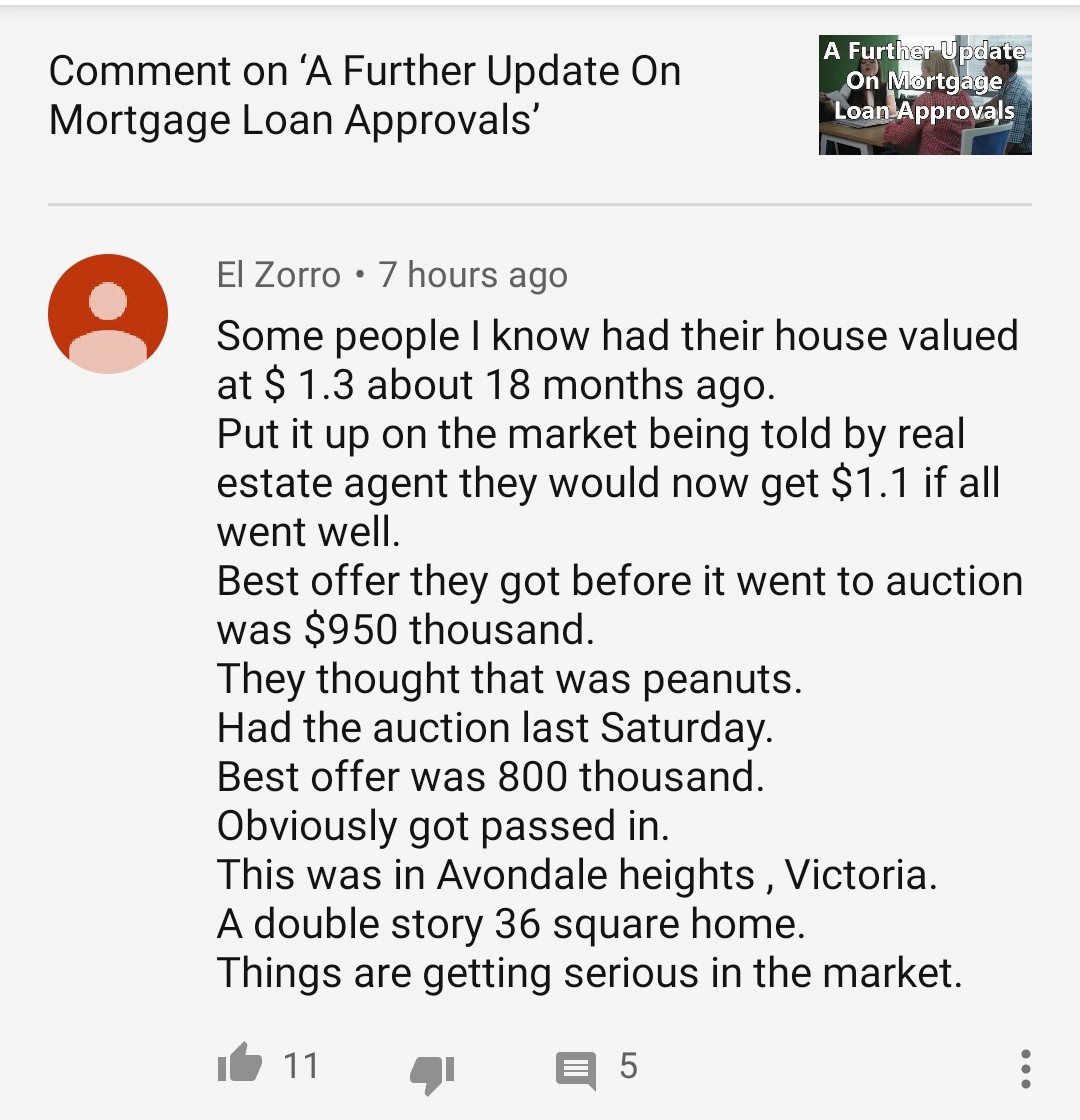

Not crashing (yet) but prices have flattened for some time, and sales have slowed. In that phase where seller's expectations have not yet adjusted to slowing demand.

I've read that there is a backlog of housing that's up for Sale now.

Vendors often pull a property off the market and wait 6 to 12months... "for things to recover"

It generally gets worse and then a degree of panic sets in when the vendor returns to market.

One commenter in NZ mentioned how one of the main online property platforms launched a function 18 months ago that allowed you to view a properties sales price history. They blocked that function after Xmas...