From mainlymacro.... unbiased economic analysis written in plain English so that even the simple-minded can understand (so long as they put aside their prejudices).

The idea that the Coalition rescued Britain from a crisis is routinely put forward as fact by both the Conservatives and Nick Clegg. Every time the media let such statements pass (as they invariably do), the language seems to get more florid: Cleggs latest is that the coalition was born in the midst of an economic firestorm. [1]

The facts say this is pure nonsense. The economy had begun to recover from the recession, and this recovery might have continued if it had not been hit on the head by domestic and Eurozone austerity. As Larry Elliott makes clear (see also here), there was no sign of any market panic, either in the markets for Sterling or government debt.

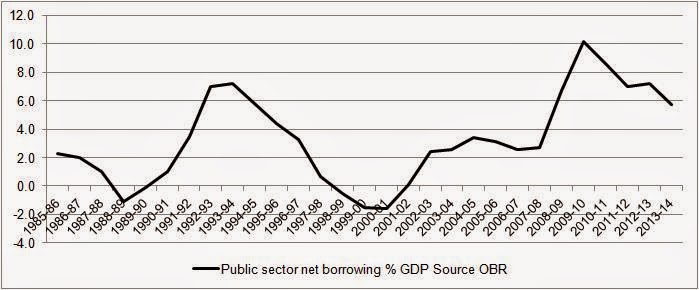

But the governments budget deficit was very large, and debt as a proportion of GDP was therefore growing. If, through a separate myth, you have created the idea that the major (perhaps only) goal of aggregate fiscal policy is to reduce deficits, this seems like a serious problem. But the deficit was rising because of the recession. It always does rise in a recession and fall in a boom, as the chart below shows. It was particularly high in 2010 because this recession was particularly deep.

Any economist would cringe at the idea that policy should try and eliminate deficits and surpluses created by the economic cycle, because that would mean destabilising the economy. This is sufficiently well known (cyclical deficits and surplus are called the automatic stabiliser) that it could undermine the idea that the high deficit was an immediate problem. This is one reason why it is important to push another mediamacro myth - the idea of Labour profligacy, which we debunk tomorrow. [2]

So where is the half-truth that gives the firestorm myth some credence? It is of course the Eurozone crisis, and the idea that the UK could suffer a similar fate to the Eurozone periphery. But academic macroeconomists understand that the situation of a country with its own central bank, like the UK, is quite different from a country without, because the central bank can (and in the UK will) act as a lender of last resort, so the government will never run out of money. That simple fact is sufficient to prevent any crisis happening for an economy like the UK. Greece was profligate, and had to default, but the crisis in the rest of the Eurozone ended the moment the European Central Bank agreed to act as a lender of last resort in 2012.

Why is it so important to keep up the pretence that in 2010 the UK economy was on the brink of a financial crisis? Because only then can the pain of the subsequent few years be excused. The truth is that the failure to recover until 2013 was not the inevitable cost of rescuing the economy from crisis, but an avoidable choice by the Coalition government. The delayed recovery, and the damage that did to living standards, was at least in part a direct consequence of attempts to reduce the deficit far too early, and there was no impending crisis that forced the government's hand. [3]